When it comes to secured vs unsecured loans, it’s like comparing the coolest trends in finance. Get ready to dive into the world of borrowing, where assets, interest rates, and risks play a major role in shaping your financial decisions.

Secured vs Unsecured Loans

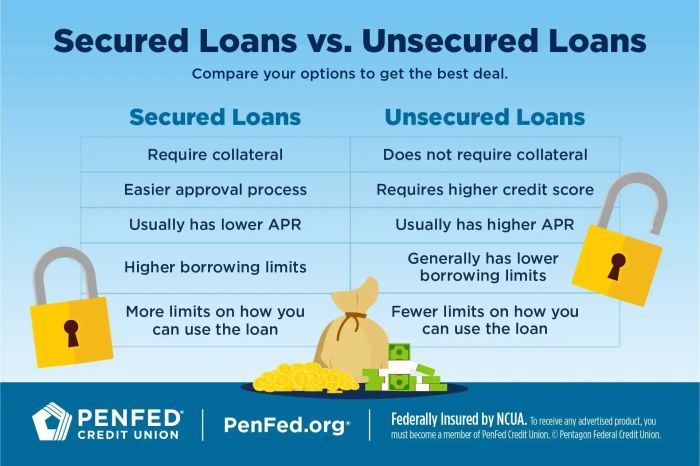

When it comes to getting a loan, understanding the key differences between secured and unsecured loans is crucial. Let’s break it down for you.

Assets Used for Securing a Loan

Secured loans require collateral, which is an asset that the lender can take if you fail to repay the loan. Common examples of assets used for securing a loan include real estate (like your home), vehicles, or savings accounts. These assets provide security for the lender in case the borrower defaults on the loan.

Impact of Collateral on Interest Rates

Having collateral for a secured loan can actually work in your favor when it comes to interest rates. Lenders see secured loans as less risky since they have a way to recoup their losses if necessary. As a result, interest rates for secured loans are typically lower compared to unsecured loans. So, if you’re willing to put up collateral, you might be able to snag a better deal on your loan.

Secured Loans

When it comes to secured loans, borrowers are required to pledge collateral, such as a home or a car, to secure the loan. This collateral acts as a form of security for the lender in case the borrower defaults on the loan. Secured loans typically have lower interest rates compared to unsecured loans because the lender has a lower risk due to the collateral.

Process of Obtaining a Secured Loan

To obtain a secured loan, the borrower must first decide on the type of collateral they will pledge. This could be a valuable asset like a home, vehicle, or savings account. The borrower then applies for the loan with the chosen collateral and the lender assesses the value of the collateral to determine the loan amount. If approved, the borrower receives the funds and agrees to the terms and conditions of repayment, including the consequences of defaulting on the loan.

Advantages and Disadvantages of Secured Loans

- Advantages:

- Lower interest rates compared to unsecured loans

- Easier approval process due to the collateral

- Potential to borrow larger amounts

- Disadvantages:

- Risk of losing the pledged collateral if unable to repay the loan

- Longer repayment terms leading to higher total interest payments

- Limited flexibility compared to unsecured loans

Risks Associated with Secured Loans

Secured loans pose risks for both the borrower and the lender. If the borrower fails to make timely payments, the lender has the right to seize the collateral to recover the loan amount. This could result in the borrower losing their valuable assets, such as their home or car. Additionally, if the value of the collateral depreciates significantly, the borrower may end up owing more than the collateral’s worth, creating a financial burden.

Unsecured Loans

When it comes to unsecured loans, borrowers don’t need to provide collateral to secure the loan, making them a popular choice for those who don’t want to risk their assets. However, qualifying for an unsecured loan typically requires a good credit score and a stable income to show lenders that you can repay the loan.

Qualifying for an Unsecured Loan

To qualify for an unsecured loan, lenders will look at your credit score, income, and debt-to-income ratio. A good credit score is usually considered to be above 670, and lenders prefer borrowers with a stable source of income and a low debt-to-income ratio.

Interest Rates for Unsecured Loans

Since unsecured loans are riskier for lenders, they often come with higher interest rates compared to secured loans. Interest rates for unsecured loans can vary depending on the lender, your credit score, and the loan amount, but they generally range from 5% to 36%.

Types of Unsecured Loans

- Personal Loans: These are general-purpose loans that can be used for various purposes, such as debt consolidation, home improvements, or unexpected expenses.

- Credit Card Loans: These are unsecured loans that allow borrowers to make purchases using a credit card and pay back the balance over time.

- Student Loans: These loans are designed to help students cover the cost of tuition, books, and other educational expenses without requiring collateral.

- Medical Loans: These loans are used to cover medical expenses, such as surgeries, treatments, or procedures, without the need for collateral.

Impact on Credit Score

When it comes to your credit score, the type of loan you have can have a significant impact. Let’s dive into how secured and unsecured loans affect your credit score differently, what happens if you default on either type of loan, and some tips on managing both responsibly to keep your credit score in good shape.

Secured vs. Unsecured Loans and Credit Scores

Secured loans are backed by collateral, such as a car or a house, while unsecured loans do not require any collateral. When you take out a secured loan, the lender has a guarantee in case you default, which can make them less risky. On the other hand, unsecured loans are riskier for lenders since they don’t have any collateral to fall back on.

Consequences of Defaulting

If you default on a secured loan, the lender can seize the collateral to recoup their losses. This can have a serious negative impact on your credit score and your ability to borrow in the future. On the other hand, defaulting on an unsecured loan can also harm your credit score, but the consequences may not be as severe since there is no collateral involved.

Tips for Managing Loans Responsibly

To maintain a good credit score, it’s important to make timely payments on both secured and unsecured loans. Keep track of your due dates, set up automatic payments if possible, and avoid borrowing more than you can afford to repay. By managing your loans responsibly, you can build a positive credit history and keep your credit score healthy.