When it comes to planning for retirement, one key aspect that often gets overlooked is the allocation of your retirement funds. This crucial step can make a significant difference in your financial security during your golden years. Let’s dive into the world of retirement fund allocation and explore why it’s essential for your future financial well-being.

Importance of Retirement Fund Allocation

Proper allocation in a retirement fund is crucial for ensuring financial security during the golden years. It involves distributing your investments across different asset classes to minimize risk and maximize returns over time.

Diversification in Retirement Fund Allocation

Diversification is key in retirement fund allocation as it helps spread risk across various investments. By investing in a mix of assets like stocks, bonds, and real estate, you can reduce the impact of market fluctuations on your overall portfolio.

Impact of Asset Allocation on Retirement Savings

Asset allocation plays a significant role in determining the performance of your retirement savings. The right mix of assets can help you achieve your long-term financial goals while balancing risk and return. It is essential to review and adjust your asset allocation periodically to align with your changing financial needs and risk tolerance.

Types of Retirement Accounts

When it comes to saving for retirement, there are several types of retirement accounts to choose from. Each type has its own set of rules, features, and benefits. Understanding the differences between these accounts can help individuals make informed decisions about where to invest their money.

401(k)

A 401(k) is a retirement account offered by many employers. Employees can contribute a portion of their pre-tax income to this account, which is then invested in a variety of options such as stocks, bonds, and mutual funds. One key feature of a 401(k) is that some employers offer matching contributions, essentially free money towards retirement.

IRA (Individual Retirement Account)

An Individual Retirement Account (IRA) is a retirement account that individuals can open on their own. There are two main types of IRAs: traditional and Roth. With a traditional IRA, contributions may be tax-deductible, but withdrawals are taxed as income in retirement. On the other hand, a Roth IRA offers tax-free withdrawals in retirement, but contributions are made with after-tax dollars.

Roth IRA

A Roth IRA is a type of retirement account that offers tax-free withdrawals in retirement. Unlike a traditional IRA, contributions to a Roth IRA are made with after-tax dollars, meaning that individuals do not get a tax deduction upfront. However, the earnings in a Roth IRA grow tax-free and withdrawals in retirement are not subject to income tax.

Strategies for Retirement Fund Allocation

When it comes to planning for retirement, determining the right mix of assets in your investment portfolio is crucial. The strategies you use for retirement fund allocation can significantly impact your financial well-being in your golden years. Let’s dive into some key strategies for effectively allocating your retirement funds.

Determining an Appropriate Asset Allocation Mix

One important strategy for retirement fund allocation is determining the appropriate mix of assets in your portfolio. This mix should be based on factors such as your age, risk tolerance, financial goals, and time horizon until retirement. A common rule of thumb is to subtract your age from 100 to determine the percentage of your portfolio that should be invested in stocks, with the remaining percentage in bonds or other fixed-income investments.

Risk Tolerance and Its Role

Understanding your risk tolerance is crucial when allocating funds for retirement. Risk tolerance refers to your ability and willingness to withstand fluctuations in the value of your investments. Younger investors may have a higher risk tolerance as they have more time to recover from market downturns, while those nearing retirement may prefer a more conservative approach to protect their savings. It’s essential to strike a balance between risk and reward that aligns with your comfort level.

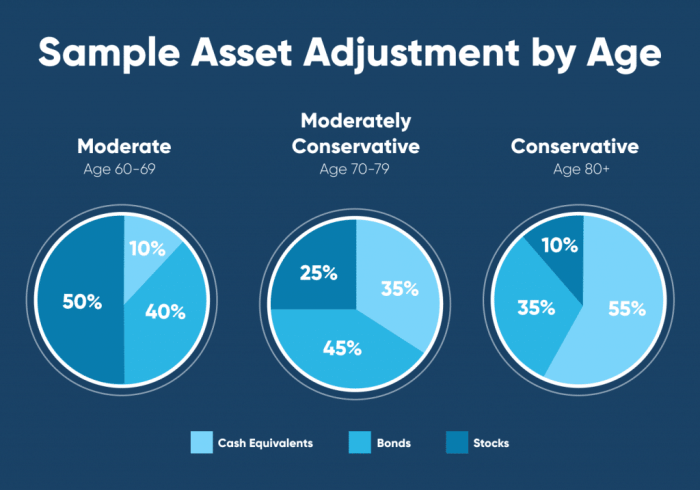

Adjusting Allocation as Retirement Nears

As you get closer to retirement age, it’s important to adjust your fund allocation to reduce risk and preserve capital. This may involve shifting a larger portion of your portfolio into more stable investments, such as bonds or cash equivalents, to protect against market volatility. Regularly reviewing and adjusting your allocation based on your changing financial needs and goals is key to ensuring a secure retirement.

Factors Influencing Retirement Fund Allocation

When it comes to allocating funds for retirement, there are several key factors that individuals need to consider. Factors such as age, income, financial goals, and market conditions play a significant role in determining the best strategies for retirement fund allocation.

Age

Age is a crucial factor to consider when allocating funds for retirement. Younger individuals typically have a longer time horizon before retirement, allowing them to take on more risk in their investments. As individuals get closer to retirement age, they may shift towards more conservative investment options to protect their savings.

Income

Income level also plays a role in retirement fund allocation decisions. Higher income earners may have more disposable income to allocate towards retirement savings, allowing them to potentially invest in a wider range of options. On the other hand, individuals with lower incomes may need to focus on more conservative and stable investment choices.

Financial Goals

Understanding one’s financial goals is essential when determining how to allocate funds for retirement. Whether the goal is to retire early, travel the world, or simply maintain a comfortable lifestyle, these goals will influence the amount of savings needed and the investment strategies to achieve them.

Market Conditions

Market conditions can have a significant impact on retirement fund allocation strategies. During periods of economic uncertainty or market volatility, individuals may need to adjust their investment allocations to protect their savings. It’s important to monitor market trends and make informed decisions based on the current economic climate.