Get ready to dive into the world of loan interest calculation, where numbers and percentages come to life in a way that will blow your mind. From simple interest to compound interest, this journey will take you through scenarios you never thought possible.

As we explore the methods, factors, and understanding behind loan interest rates, be prepared for a wild ride of knowledge and insight.

Loan Interest Calculation Methods

When it comes to calculating loan interest, there are different methods that lenders use to determine how much borrowers owe. The two most common methods are simple interest calculation and compound interest calculation.

Simple Interest Calculation

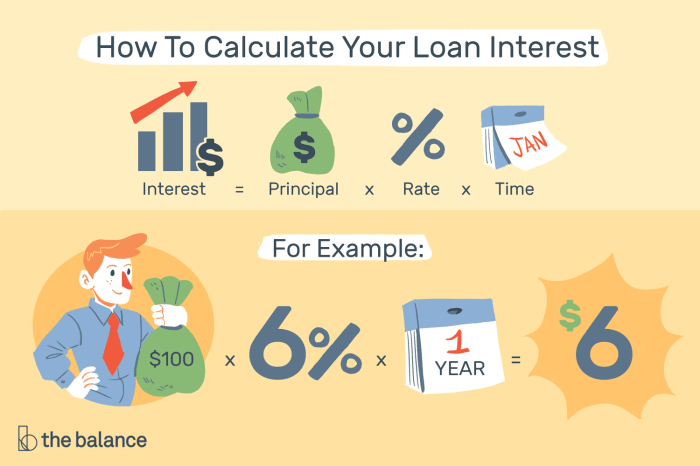

Simple interest is calculated on the principal amount of a loan or deposit. The formula for calculating simple interest is:

Simple Interest = Principal x Rate x Time

For example, if you borrow $1,000 at an annual interest rate of 5% for 2 years, the simple interest would be:

$1,000 x 0.05 x 2 = $100

Compound Interest Calculation

Compound interest is calculated on the initial principal amount and also on the accumulated interest from previous periods. The formula for calculating compound interest is:

Compound Interest = P(1 + r/n)^(nt) – P

Where:

P = principal amount

r = annual interest rate

n = number of times interest is compounded per year

t = number of years

For example, if you borrow $1,000 at an annual interest rate of 5% compounded annually for 2 years, the compound interest would be:

$1,000(1 + 0.05/1)^(1*2) – $1,000 = $102.50

Factors Affecting Loan Interest Rates

When it comes to loan interest rates, there are several key factors that play a role in determining how much interest you’ll have to pay. These factors can influence the overall cost of borrowing money and impact your financial decisions. Understanding these factors is essential for making informed choices when taking out a loan.

Inflation Impact on Interest Rates

Inflation is a significant factor that can affect loan interest rates. When inflation rates are high, the purchasing power of money decreases, leading to an increase in the cost of goods and services. In response to inflation, central banks may raise interest rates to control inflation and stabilize the economy. This increase in interest rates can also impact the rates on loans, making borrowing more expensive for consumers.

Role of Credit Scores in Loan Interest Rates

Credit scores play a crucial role in determining the interest rate you’ll receive on a loan. Lenders use credit scores to assess your creditworthiness and determine the risk of lending you money. A higher credit score indicates a lower risk for the lender, which can result in lower interest rates on loans. On the other hand, a lower credit score may lead to higher interest rates or even difficulty in securing a loan. It’s important to maintain a good credit score to access more favorable loan terms and save money on interest payments.

Understanding APR vs. Interest Rate

When it comes to borrowing money, it’s essential to understand the difference between Annual Percentage Rate (APR) and the interest rate on a loan. While both are important components of a loan, they serve different purposes and can impact the overall cost of borrowing significantly.

APR vs. Interest Rate

The interest rate on a loan represents the percentage of the principal amount that a lender charges for borrowing money. This rate determines the monthly payment amount and the total amount repaid over the loan term. On the other hand, the APR includes not only the interest rate but also any additional fees or costs associated with the loan, such as origination fees, closing costs, or points. These fees are expressed as a yearly rate and added to the interest rate to give a more comprehensive picture of the total cost of borrowing.

- For example, let’s say you are comparing two loans: Loan A with an interest rate of 5% and Loan B with an APR of 6.5%. While Loan A has a lower interest rate, Loan B’s APR is higher because it includes additional fees. This means that even though Loan A may seem more attractive at first, Loan B could end up being the cheaper option in the long run due to the lower APR.

- Understanding the difference between APR and interest rate is crucial for borrowers because it allows them to make more informed decisions when comparing loan offers. By looking at the APR, borrowers can see the true cost of borrowing and choose the loan that offers the best overall value.

Loan Amortization and Interest Paid Over Time

When it comes to loan amortization, it refers to the process of paying off a loan over a set period of time through regular payments. Each payment is typically split between the principal amount borrowed and the interest charged by the lender. Understanding how loan amortization works can give you insight into how much interest you will end up paying over the life of the loan.

Breakdown of Principal and Interest Payments

- During the early stages of a loan, the majority of your monthly payment goes towards paying off the interest accrued. As you continue to make payments, the portion allocated to the principal amount increases.

- A table showing the breakdown of principal and interest payments over different loan periods can help visualize how much of each payment goes towards reducing the loan balance and how much is attributed to interest.

Impact of Making Extra Payments

- By making extra payments towards the principal amount of the loan, you can reduce the total interest paid over the life of the loan. This is because paying down the principal faster decreases the amount of interest that accrues over time.

- Even small additional payments can have a significant impact on the total interest paid, ultimately helping you pay off the loan sooner and save money in interest charges.