Step into the world of finance with a unique twist as we delve into the realm of index funds explained. Get ready for a rollercoaster ride of knowledge and insights that will leave you wanting more.

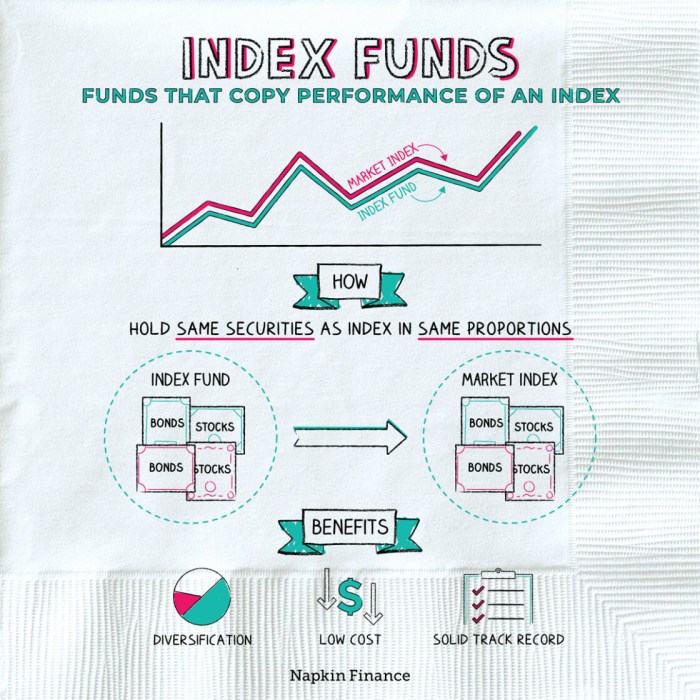

Index funds are a type of mutual fund or exchange-traded fund (ETF) that passively tracks a specific market index, like the S&P 500. Unlike actively managed funds where fund managers try to beat the market, index funds aim to replicate the performance of the index they are tracking. Investing in index funds can offer a cost-effective and diversified approach to long-term growth.

What are index funds?

Index funds are a type of investment fund that aims to replicate the performance of a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. Unlike actively managed funds, index funds are passively managed and seek to match the returns of the index they are tracking rather than trying to outperform it through active trading.

When you invest in an index fund, you are essentially investing in a diversified portfolio of stocks or bonds that mirror the components of the chosen index. This means that as the index goes up or down, the value of your investment will follow suit.

How do index funds track specific market indexes?

Index funds use a strategy called indexing, where they buy and hold the same securities that are included in the target index. By holding a representative sample of the index’s components, index funds can closely track the performance of the market index they are designed to follow. This passive approach helps keep costs low, as there is minimal trading involved.

- Index funds typically have lower fees compared to actively managed funds, making them a cost-effective investment option.

- They offer broad diversification across different sectors and industries, reducing the risk of investing in individual stocks.

- Index funds provide consistent returns over the long term, as they aim to match the performance of the overall market.

By investing in index funds, you can benefit from the overall growth of the market without the need for constant monitoring or active decision-making.

How do index funds work?

Index funds operate using a passive investment approach, aiming to replicate the performance of a specific market index. This means that instead of actively selecting individual stocks or securities, index funds simply track the performance of a particular index, such as the S&P 500.

Role of Diversification in Index Fund Investments

Diversification plays a crucial role in index fund investments as it helps spread risk across a wide range of assets within the index. By holding a diverse portfolio of securities, index funds reduce the impact of any single stock’s poor performance on the overall fund. This helps investors minimize risk and achieve more stable returns over the long term.

- Index funds typically hold a large number of stocks or bonds that make up the index they are tracking.

- By investing in multiple companies or assets, index funds ensure that the performance of the fund is closely aligned with the performance of the overall market.

- Diversification also helps investors avoid the risk associated with individual stock selection and market timing, which can be challenging even for experienced investors.

Types of index funds

When it comes to index funds, there are several types available to investors. Each type has its own unique characteristics and benefits. Let’s take a closer look at the different types of index funds and compare their features.

Total Market Index Funds

Total market index funds aim to track the performance of a broad market index, such as the S&P 500 or the Wilshire 5000. These funds provide investors with exposure to the entire stock market, offering diversification across various sectors and industries. Examples of popular total market index funds include Vanguard Total Stock Market Index Fund and Fidelity Total Market Index Fund.

Sector-Specific Index Funds

Sector-specific index funds focus on a particular sector of the economy, such as technology, healthcare, or energy. These funds allow investors to target their investments in a specific industry while still benefiting from the diversification of an index fund. Examples of sector-specific index funds include the Technology Select Sector SPDR Fund (XLK) and the Health Care Select Sector SPDR Fund (XLV).

International Index Funds

International index funds invest in stocks from foreign markets outside the United States. These funds provide exposure to international markets and can help investors diversify their portfolios globally. Examples of popular international index funds include the Vanguard FTSE All-World ex-US Index Fund and the iShares MSCI EAFE ETF.

Benefits of investing in index funds

Index funds offer several advantages that make them an attractive option for investors looking to build a diversified portfolio with minimal fees and risks.

Lower fees compared to actively managed funds

Index funds typically have lower management fees compared to actively managed funds. Since index funds aim to replicate the performance of a specific market index, they require less active management, resulting in lower costs for investors.

Broad market exposure and reduced risk

By investing in an index fund, investors gain exposure to a wide range of securities that make up the underlying index. This diversification helps spread out risk and reduces the impact of any individual stock’s performance on the overall portfolio.

Tax efficiency of index funds

Index funds are known for their tax efficiency because they have lower portfolio turnover compared to actively managed funds. This means that investors are less likely to incur capital gains taxes from frequent buying and selling of securities within the fund, making index funds a tax-efficient investment option.

Considerations before investing in index funds

Before diving into the world of index funds, there are a few key considerations to keep in mind to ensure you’re making the right choice for your investment strategy. Let’s break it down.

Determining Suitability Based on Investment Goals and Risk Tolerance

- Consider your investment goals: Are you saving for retirement, a major purchase, or just looking to grow your wealth over time?

- Evaluate your risk tolerance: How comfortable are you with fluctuations in the market? Are you willing to take on more risk for potentially higher returns?

- Align your investment goals and risk tolerance with the type of index fund that best suits your needs.

Importance of Expense Ratios and Tracking Errors

- Expense ratios: These fees can eat into your returns over time, so look for index funds with low expense ratios to maximize your profits.

- Tracking errors: These discrepancies between the fund’s performance and the index it tracks can impact your returns. Choose index funds with minimal tracking errors for more accurate results.

Impact of Dividends and Capital Gains on Index Fund Returns

- Dividends: Some index funds distribute dividends from the stocks they hold, providing additional income for investors.

- Capital gains: When the fund’s underlying securities are sold at a profit, investors may receive capital gains distributions, which can affect your overall returns.

- Understand how dividends and capital gains play a role in the total return of the index fund you’re considering.