Index fund advantages set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. From lower fees to diversified assets, index funds provide a unique investment opportunity that is worth exploring.

As we delve deeper into the advantages of index funds, a world of financial possibilities unfolds, paving the way for a brighter and more secure investment future.

Definition of Index Funds

Index funds are a type of mutual fund or exchange-traded fund (ETF) that is designed to track a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. Unlike actively managed funds, which aim to outperform the market, index funds aim to replicate the performance of the index they are tracking.

Underlying Principle of Index Funds

Index funds work on the principle of passive investing, where the fund manager simply buys the same securities that are included in the chosen index. This strategy eliminates the need for constant buying and selling of securities, which can lead to lower fees and taxes for investors.

- By tracking a specific market index, index funds provide investors with broad market exposure and diversification.

- Since index funds are not actively managed, they tend to have lower expense ratios compared to actively managed funds.

- Investors can choose from a variety of index funds that track different indices, allowing them to customize their investment portfolio based on their risk tolerance and investment goals.

Popular Market Indices for Index Funds

Some examples of popular market indices that index funds may track include:

- S&P 500: An index of the 500 largest publicly traded companies in the United States.

- Dow Jones Industrial Average: An index of 30 large, publicly traded companies in the United States.

- NASDAQ Composite: An index of more than 2,500 common stocks listed on the NASDAQ stock exchange.

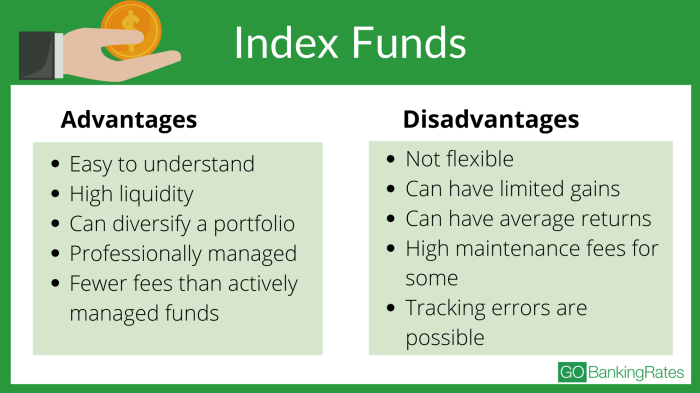

Advantages of Index Funds

Index funds offer several advantages that make them a popular choice for investors looking to build a diversified portfolio with low fees and consistent returns over the long term.

Lower Fees

Index funds typically have lower management fees compared to actively managed funds. This is because index funds passively track a specific market index, such as the S&P 500, and do not require active trading or research by fund managers. As a result, investors can benefit from lower costs and potentially higher returns over time.

Diversification

One of the key advantages of index funds is the built-in diversification they offer. By investing in a wide range of assets that make up a particular index, such as stocks from different industries and sectors, index funds help spread risk and reduce the impact of volatility in any single stock. This diversification can help protect investors from significant losses and provide a more stable investment option.

Consistent Returns

Another advantage of index funds is the potential for consistent returns over the long term. While individual stocks may experience fluctuations in value, index funds tend to reflect the overall performance of the market or specific index they track. This can lead to more predictable returns for investors who are looking to grow their wealth steadily over time without taking on excessive risk.

Overall, index funds offer a compelling investment option for those seeking a cost-effective, diversified, and stable way to grow their wealth over the long term.

Risk Management in Index Funds

Index funds play a crucial role in managing risks for investors by providing broad market exposure and diversification. This helps mitigate individual stock risk and reduces the impact of market fluctuations on the overall performance of the fund. Let’s delve into how index funds excel in risk management.

Broad Market Exposure

Index funds offer investors exposure to a wide range of stocks within a particular index, such as the S&P 500 or the Nasdaq. By holding a diversified portfolio of stocks, index funds reduce the risk associated with investing in individual companies. This diversification helps spread out risk and minimizes the negative impact of poor performance by any single stock on the overall fund.

Less Impact from Market Fluctuations

Due to their diversified nature, index funds are less susceptible to the short-term fluctuations that can affect individual stocks or sectors. Market volatility may impact certain stocks or sectors more than others, but the broad exposure provided by index funds helps cushion the impact of these fluctuations. This can lead to more stable returns for investors over the long term.

Aligning with Risk Profiles

Investors have different risk tolerances based on their financial goals, time horizon, and comfort level with market fluctuations. Index funds offer a range of options that cater to various risk profiles, from conservative to aggressive. Investors can choose an index fund that aligns with their risk tolerance, allowing them to participate in the market while managing risk according to their individual preferences.

Tax Efficiency of Index Funds

When it comes to taxes, index funds have a reputation for being tax-efficient investment vehicles. This is mainly due to their passive management style and low turnover rate, which results in lower capital gains distributions compared to actively managed funds. As a result, investors in index funds often face reduced tax implications, allowing them to keep more of their investment returns.

Tax-Loss Harvesting

Tax-loss harvesting is a strategy used by investors to offset capital gains by selling investments that have experienced a loss. This can be particularly beneficial for index fund investors as it allows them to minimize taxes on their gains. By strategically selling losing investments to offset gains, investors can reduce their overall tax liability and potentially increase their after-tax returns.

Impact of Taxes on Investment Returns

Taxes can have a significant impact on investment returns, reducing the overall profitability of an investment. Index funds, with their lower capital gains distributions and tax-efficient structure, can offer investors a way to minimize the impact of taxes on their returns. By keeping taxes low, index funds can help investors maximize their after-tax returns and potentially grow their wealth more effectively.