Yo, diving into Financial wellness programs, this intro is all about giving you the lowdown in a fresh and engaging way that’ll keep you hooked.

So, buckle up as we break down the nitty-gritty of financial wellness programs and why they’re a game-changer in the workplace.

Overview of Financial Wellness Programs

Financial wellness programs are initiatives implemented by organizations to help employees manage their finances better. These programs aim to improve the overall financial well-being of employees by providing resources, tools, and education on various financial topics.

One of the key benefits of implementing financial wellness programs in the workplace is increased employee satisfaction and engagement. When employees feel more in control of their finances, they are less stressed and more focused at work. This can lead to higher productivity and lower turnover rates.

Key components typically included in financial wellness programs are:

Financial Education

Financial literacy workshops, seminars, and online resources to help employees understand basic financial concepts such as budgeting, saving, investing, and debt management.

Financial Planning

Access to financial advisors or tools to help employees create personalized financial plans based on their goals and circumstances.

Employee Benefits Education

Information sessions on company benefits such as retirement plans, health insurance, and other perks to ensure employees are taking full advantage of their benefits package.

Wellness Challenges

Incentive programs or challenges that promote healthy financial habits such as saving a certain amount of money or reducing unnecessary expenses.

Support Services

Access to counseling services or financial assistance programs for employees facing financial difficulties or unexpected expenses.

Types of Financial Wellness Programs

Financial wellness programs come in various forms to cater to the diverse needs of organizations and employees. Two common types include structured financial education programs and personalized financial coaching.

Structured Financial Education Programs

Structured financial education programs typically consist of workshops, seminars, or online courses that cover a wide range of financial topics. These programs aim to enhance employees’ knowledge and skills in areas such as budgeting, saving, investing, and retirement planning. By providing structured content and resources, organizations can help employees build a strong foundation of financial literacy.

- Topics covered may include:

- Basic money management

- Debt management

- Financial goal setting

- Understanding benefits and retirement plans

Structured financial education programs are beneficial for employees who prefer a more formal and organized approach to learning about financial matters.

Personalized Financial Coaching

On the other hand, personalized financial coaching involves one-on-one sessions with a financial advisor or coach. These sessions are tailored to the individual needs and goals of employees, providing personalized guidance and support in achieving their financial objectives. Personalized financial coaching can be especially effective for employees who require more personalized attention and guidance in managing their finances.

- Benefits of personalized financial coaching:

- Customized financial planning

- Goal setting and accountability

- Behavioral change support

- Continuous guidance and feedback

Personalized financial coaching can help employees make meaningful changes in their financial habits and achieve long-term financial wellness.

Examples of Successful Financial Wellness Programs

Several companies have implemented successful financial wellness programs to support their employees’ financial well-being. For instance, XYZ Corporation offers a combination of structured financial education programs and personalized financial coaching sessions to its employees. This comprehensive approach has helped employees improve their financial literacy, reduce debt, and increase savings.

Another example is ABC Company, which partners with financial institutions to provide workshops and seminars on various financial topics. These programs have empowered employees to make informed financial decisions, plan for their future, and achieve financial stability.

By offering a mix of structured education and personalized coaching, companies can effectively address the diverse financial needs of their employees and promote a culture of financial wellness in the workplace.

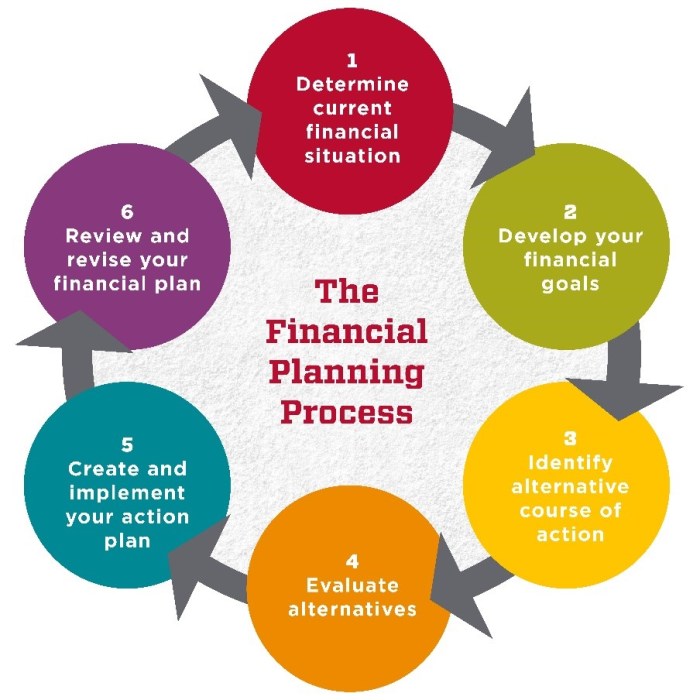

Implementing Financial Wellness Programs

Implementing a financial wellness program in the workplace involves careful planning and execution to ensure its success. By following specific steps and strategies, employers can effectively promote employee engagement with financial wellness initiatives and measure the program’s effectiveness.

Designing and Implementing a Financial Wellness Program

- Conduct a needs assessment to understand the financial challenges and goals of employees.

- Collaborate with financial experts to design a program tailored to address the identified needs.

- Implement the program through various channels such as workshops, webinars, and one-on-one consultations.

- Evaluate the program regularly to make necessary adjustments and improvements.

Promoting Employee Engagement

- Offer incentives or rewards for participation in financial wellness activities.

- Create a supportive work environment that encourages open discussions about financial matters.

- Provide ongoing education and resources to help employees improve their financial literacy.

- Encourage leadership to lead by example and participate in the program themselves.

Measuring Effectiveness

- Track key metrics such as employee participation rates, financial behavior changes, and satisfaction levels.

- Collect feedback from employees through surveys or focus groups to gauge the program’s impact.

- Compare financial wellness program outcomes to pre-established goals and benchmarks.

- Utilize data analytics tools to generate reports and insights for continuous improvement.

Impact of Financial Wellness Programs

Financial wellness programs can have a significant impact on employee productivity and morale. When employees feel financially secure, they are less stressed about money matters and can focus better on their work. This can lead to increased productivity and a more positive work environment.

Reducing Workplace Stress

Financial wellness programs can help reduce workplace stress by providing employees with the resources and tools they need to manage their finances effectively. This includes budgeting assistance, debt management programs, and access to financial education resources. By alleviating financial stress, employees can feel more at ease and focused at work.

Long-Term Financial Stability

Financial wellness programs play a crucial role in helping employees achieve long-term financial stability. By offering retirement planning services, investment guidance, and savings incentives, these programs empower employees to make smart financial decisions that can benefit them in the long run. This not only improves the financial well-being of individuals but also contributes to their overall job satisfaction and loyalty to the company.