With credit history report at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling journey filled with unexpected twists and insights.

Ever wondered what’s in that mysterious credit history report of yours? Buckle up as we dive into the world of credit scores and financial profiles.

Understanding Credit History Report

Credit history report is a detailed record of an individual’s financial history, including their borrowing and repayment activities. It provides a snapshot of a person’s creditworthiness and financial habits, which is crucial for various financial decisions.

Components of Credit History Report

A credit history report typically includes the following components:

- Personal Information: Name, address, social security number, and date of birth.

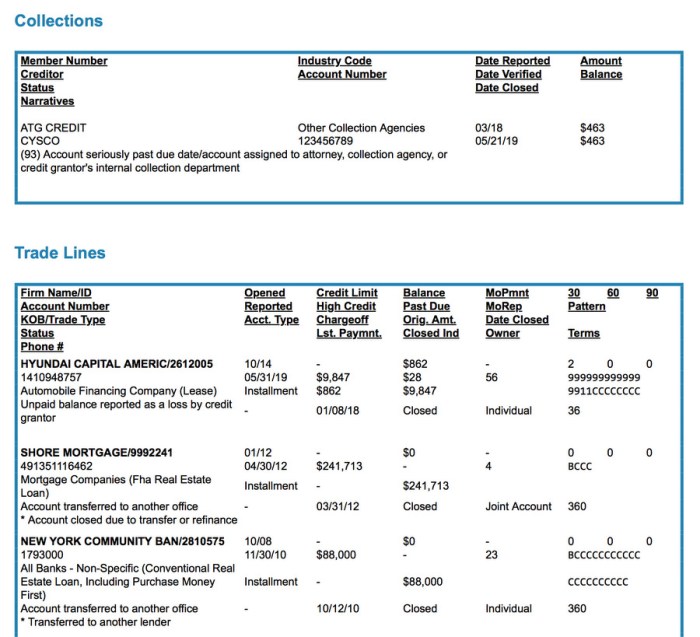

- Credit Accounts: Details of all credit accounts held by the individual, including balances, payment history, and credit limits.

- Public Records: Any bankruptcies, tax liens, or court judgments that may impact the individual’s credit.

- Inquiries: Records of entities that have requested the individual’s credit report.

- Credit Score: A numerical representation of the individual’s creditworthiness based on the information in the report.

Uses of Credit History Report

Credit history reports are used by lenders, employers, landlords, and other entities to assess an individual’s financial responsibility and reliability. Lenders use credit reports to determine whether to approve a loan and set interest rates. Employers may use credit reports as part of the background check process to evaluate a candidate’s trustworthiness. Landlords may review credit reports to assess a potential tenant’s ability to make timely rent payments. Overall, credit history reports play a critical role in shaping financial opportunities and decisions for individuals.

Obtaining a Credit History Report

When it comes to obtaining your credit history report, there are a few key steps to keep in mind. By understanding the process and importance of reviewing your credit report regularly, you can stay on top of your financial health and make informed decisions.

Requesting a Free Credit Report

- Contact major credit bureaus like Equifax, Experian, and TransUnion to request a free copy of your credit report. You are entitled to one free report from each bureau per year.

- You can request your credit report online, by phone, or through mail. Make sure to provide accurate personal information to verify your identity.

- Review the information provided in your credit report carefully for any errors or suspicious activity. This can help you identify potential issues and take steps to address them.

Importance of Regularly Reviewing Credit History Reports

- Regularly reviewing your credit history report allows you to monitor your financial activity and detect any fraudulent transactions or inaccuracies.

- By staying informed about your credit report, you can identify areas for improvement and take steps to boost your credit score over time.

- Monitoring your credit report can also help you spot potential identity theft or unauthorized accounts opened in your name.

Interpreting Information in Credit History Report

- Pay attention to your credit score, which reflects your creditworthiness to lenders. A higher score indicates better credit health.

- Check for any late payments, collections, or accounts in default, as these can negatively impact your credit score.

- Review the detailed account information, including balances, payment history, and account status, to ensure accuracy and identify areas for improvement.

Factors Impacting Credit History

When it comes to credit history reports, there are several factors that can have a significant impact on your overall score. These factors can either positively or negatively influence your creditworthiness and ability to obtain credit in the future.

Positive Factors:

Positive Factors

- Timely Payments: Making on-time payments consistently demonstrates responsible financial behavior and can boost your credit score.

- Low Credit Utilization: Keeping your credit card balances low in relation to your credit limits shows that you are not heavily reliant on credit and can help improve your score.

- Diverse Credit Mix: Having a mix of different types of credit, such as credit cards, loans, and a mortgage, can showcase your ability to manage various financial responsibilities.

Negative Impact:

Negative Impact

- Missed Payments: Failing to make payments on time can significantly lower your credit score and indicate financial irresponsibility.

- High Credit Utilization: Using a large portion of your available credit can suggest that you are overextended financially and may lead to a lower credit score.

- Credit Inquiries: Multiple hard inquiries on your credit report within a short period of time can signal to lenders that you are actively seeking credit, which may be a red flag for potential risk.

Improving Credit History Reports

Improving your credit history report is crucial for your financial health and future opportunities. By taking proactive steps, you can enhance your creditworthiness and access better financial products.

Paying Bills on Time and Reducing Debt

- One of the most effective ways to improve your credit history is by paying your bills on time. Late payments can significantly impact your credit score, so make sure to set up reminders or automatic payments to avoid missing deadlines.

- Reducing your overall debt can also have a positive impact on your credit history. Aim to lower your credit card balances and avoid maxing out your credit cards, as high credit utilization can negatively affect your credit score.

- Consider creating a budget to track your expenses and prioritize paying off high-interest debts first. By managing your debt responsibly, you can gradually improve your credit history over time.

Role of Credit Counseling and Debt Management Programs

- Credit counseling services offer personalized guidance on managing your finances and improving your credit history. A credit counselor can help you create a debt repayment plan, negotiate with creditors, and provide financial education to empower you to make better financial decisions.

- Debt management programs, offered by credit counseling agencies, can consolidate your debts into one monthly payment and negotiate lower interest rates with creditors. These programs can help you pay off your debts faster and improve your credit history in the process.

- Working with a reputable credit counseling agency can provide you with the support and tools you need to take control of your finances and build a stronger credit profile.

Disputing Inaccuracies in Credit History Reports

- Regularly review your credit history report for any inaccuracies or errors that could be negatively impacting your credit score. Common discrepancies include incorrect personal information, accounts that don’t belong to you, or outdated negative information.

- If you identify any inaccuracies, file a dispute with the credit bureaus to have the errors corrected. Provide supporting documentation to back up your claim and follow up to ensure the corrections are made promptly.

- Disputing inaccuracies in your credit history report can help improve your credit score and ensure that your creditworthiness is accurately reflected to lenders and creditors.