Yo, listen up! We’re diving into the world of compound interest calculator – a tool that’s gonna change the game. Get ready for some real talk mixed with solid facts that’ll make your financial planning game strong.

Now, let’s break it down and see what this calculator is all about.

Introduction to Compound Interest Calculator

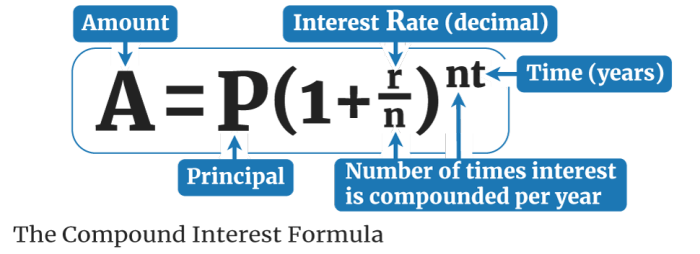

Compound interest is the addition of interest to the principal sum of a loan or deposit, or in other words, interest on interest. A compound interest calculator is a tool that helps calculate the growth of an investment or debt over time when compound interest is applied.

When and Why to Use a Compound Interest Calculator

- When planning for retirement: By calculating compound interest, individuals can determine how much they need to save each month to reach their retirement goals.

- For investments: Investors can use the calculator to estimate how their investments will grow over time with compound interest.

- For loans and debts: Borrowers can see how much they will owe in the future by factoring in compound interest on their loans.

Benefits of Using a Compound Interest Calculator

- Accurate projections: The calculator provides precise estimates of how investments or debts will grow over time.

- Time-saving: Instead of manually calculating compound interest, the calculator does the work quickly and efficiently.

- Financial planning: Helps individuals make informed decisions about their finances based on accurate compound interest calculations.

How to Use a Compound Interest Calculator

To make the most out of a compound interest calculator, you need to understand how to input the right data. Here’s a step by step guide on how to do it effectively.

Inputting Data

- Start by entering the principal amount, which is the initial sum of money you are investing or borrowing.

- Next, input the interest rate, which is the percentage added to the principal amount for each period.

- Then, specify the compounding frequency, which is how often the interest is calculated and added to the principal.

- Lastly, enter the time period, which is the length of time the money is invested or borrowed for.

Maximizing Usage

- Experiment with different scenarios by adjusting the variables to see how they impact the final amount.

- Use the calculator to compare different investment options and choose the one with the highest return.

- Regularly update the data to track the growth of your investment over time and make informed decisions.

Understanding the Results

When you use a compound interest calculator, the results provided can give you valuable insights into how your investment will grow over time. Understanding these results is crucial for making informed financial decisions.

Compound interest is a powerful concept where the interest earned on an investment is added to the principal, allowing for exponential growth over time. As the interest is calculated on both the initial principal and the accumulated interest, the total amount grows at an increasing rate.

Interpreting Compound Interest Growth

- Compound interest grows exponentially, meaning the amount you earn increases at a faster rate as time goes on.

- Even small changes in the interest rate or the frequency of compounding can have a significant impact on the final amount.

- Longer investment periods lead to larger returns due to the compounding effect.

Compound interest is often referred to as the “eighth wonder of the world” – Albert Einstein

Significance of Compound Interest in Investment Planning

- Compound interest plays a crucial role in long-term wealth accumulation, allowing your money to work for you over time.

- By understanding how compound interest works, you can make strategic decisions to maximize your returns and achieve your financial goals.

- Investors who start early and allow their investments to compound over time can benefit greatly from the power of compound interest.

Comparing Compound Interest Calculators

When it comes to comparing compound interest calculators online, it’s essential to look at the features that differentiate one from another. Choosing a reliable calculator can make a significant difference in accurately calculating your compound interest over time.

User-Friendly Interface

Some compound interest calculators offer a user-friendly interface that makes it easy to input your data and quickly see the results. Look for calculators that have clear instructions and intuitive design to ensure a smooth user experience.

Customization Options

Different calculators may provide various customization options, such as different compounding frequencies, additional contributions, or varying interest rates. Consider your specific needs and find a calculator that allows you to input the parameters relevant to your financial situation.

Graphical Representations

Certain compound interest calculators go the extra mile by providing graphical representations of your results. Visualizing how your money grows over time can enhance your understanding of compound interest and help you make informed financial decisions.

Accuracy and Reliability

Above all, it’s crucial to choose a compound interest calculator that is accurate and reliable. Opt for calculators that are endorsed by reputable financial institutions or have positive reviews from users who have tested their accuracy.