Diving headfirst into the world of 401(k) withdrawal penalties, we uncover the secrets and complexities surrounding this financial topic. Brace yourself for a rollercoaster ride of information and insights that will leave you enlightened and empowered.

Exploring the nuances of penalties for early 401(k) withdrawals can shed light on the importance of careful financial planning and decision-making.

Overview of 401(k) Withdrawal Penalties

401(k) withdrawal penalties are fees imposed on individuals who take money out of their 401(k) retirement accounts before reaching a certain age, typically before 59 ½. These penalties are in place to discourage early withdrawals and ensure that individuals use their 401(k) savings for retirement purposes.

Early withdrawal penalties from a 401(k) account serve a dual purpose. Firstly, they act as a disincentive for individuals to tap into their retirement savings prematurely, as these funds are intended to support individuals during their retirement years. Secondly, these penalties help protect the tax advantages associated with 401(k) accounts, as withdrawals before the specified age can undermine the tax-deferred growth of the investments.

How 401(k) Withdrawal Penalties Differ from Regular Income Tax Penalties

- 401(k) withdrawal penalties are specifically targeted at early distributions from retirement savings accounts, whereas regular income tax penalties apply to all income earned by an individual.

- While regular income tax penalties are based on the individual’s tax bracket and income level, 401(k) withdrawal penalties are a fixed percentage of the amount withdrawn prematurely.

- 401(k) withdrawal penalties are in addition to any income tax owed on the withdrawn amount, making early withdrawals from a 401(k) even more costly.

Types of 401(k) Withdrawal Penalties

When it comes to early 401(k) withdrawals, there are several penalties that individuals need to be aware of. These penalties are designed to discourage people from dipping into their retirement savings too soon.

Penalty for Withdrawing Funds Before Age 59½

If you withdraw funds from your 401(k) before reaching the age of 59½, you will typically face a 10% early withdrawal penalty on top of the regular income taxes you owe on the distribution. This penalty is in place to encourage individuals to keep their retirement savings intact until they reach retirement age.

Penalties for Not Following Required Minimum Distribution (RMD) Rules

Once you reach the age of 72, you are required to start taking distributions from your 401(k) account. Failure to follow the Required Minimum Distribution (RMD) rules can result in a hefty penalty of 50% of the amount that should have been withdrawn. It’s crucial to adhere to these rules to avoid facing substantial penalties that could significantly impact your retirement savings.

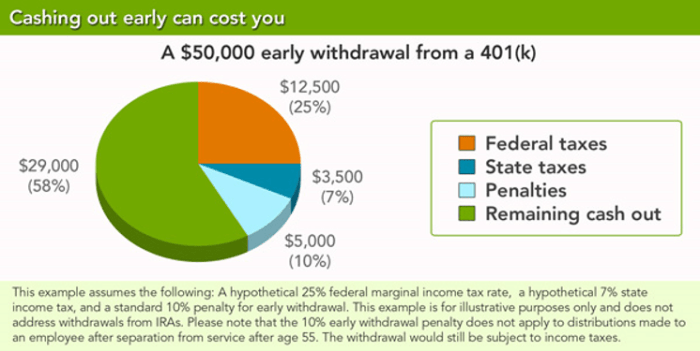

Calculation of 401(k) Withdrawal Penalties

When it comes to withdrawing money from your 401(k) before retirement age, you may face penalties that can significantly impact your savings. Let’s break down how these penalties are calculated and the tax implications involved.

Early Withdrawal Penalties

- Early withdrawals from your 401(k) before the age of 59 ½ typically incur a 10% penalty on the withdrawn amount.

- This penalty is on top of the regular income tax you will need to pay on the withdrawn funds.

- For example, if you withdraw $10,000 early, you will owe $1,000 (10%) as a penalty in addition to your regular income tax.

Tax Implications of Different Withdrawal Scenarios

- Withdrawals from a traditional 401(k) are subject to income tax at your ordinary tax rate.

- However, withdrawals from a Roth 401(k) may not be subject to income tax as long as certain conditions are met.

- Converting your traditional 401(k) to a Roth 401(k) before withdrawing funds can impact the tax treatment of your withdrawals.

Impact of Penalties on the Overall Value of the 401(k) Account

- Penalties for early withdrawals can significantly reduce the overall value of your 401(k) account.

- Not only do you lose a portion of your savings to penalties, but you also miss out on the potential growth of that money over time.

- It’s essential to consider the long-term consequences of early withdrawals on your retirement savings.

Strategies to Avoid or Minimize 401(k) Withdrawal Penalties

When it comes to accessing your 401(k) funds, it’s important to be aware of the penalties that may apply. Here are some strategies to help you avoid or minimize these penalties and make the most of your retirement savings.

Avoiding Early Withdrawal Penalties

- Consider taking out a loan from your 401(k) instead of making a withdrawal. This way, you can avoid penalties as long as you repay the loan on time.

- Explore other sources of funds before tapping into your 401(k), such as emergency savings, personal savings, or other investments.

- Look into qualifying hardship distributions that may exempt you from penalties under specific circumstances, such as medical expenses or buying a first home.

Minimizing Penalties through Proper Planning

- Plan your withdrawals strategically to avoid large lump sum withdrawals that could incur higher penalties.

- Consider partial withdrawals instead of taking out the full amount to reduce the impact of penalties on your savings.

- Consult with a financial advisor to develop a withdrawal strategy that minimizes penalties and maximizes the longevity of your retirement funds.

Long-Term Consequences of Frequent or Large Withdrawals

- Repeated withdrawals from your 401(k) can significantly reduce the amount of funds available for your retirement years.

- Large withdrawals may also trigger higher tax liabilities, further diminishing the value of your savings over time.

- By understanding the long-term consequences of withdrawals, you can make more informed decisions about when and how to access your 401(k) funds.