Dive into the world of mortgage loans, where a variety of options await to suit your financial needs. From fixed-rate to government-backed mortgages, explore the landscape of borrowing for your dream home.

Discover the ins and outs of each mortgage type, from the stability of fixed-rate loans to the flexibility of adjustable-rate mortgages. Let’s break it down and find the perfect fit for you.

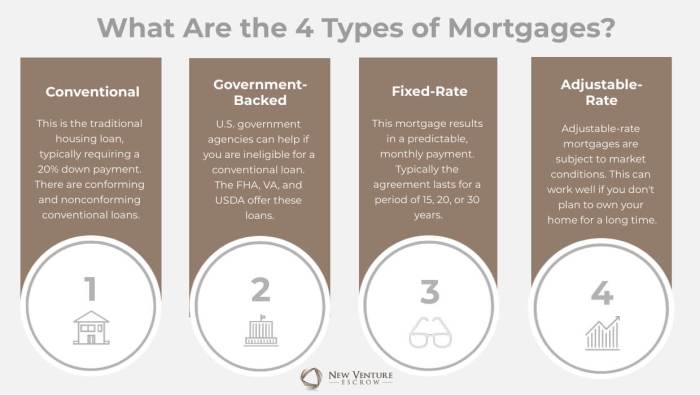

Types of Mortgage Loans

When it comes to getting a mortgage, there are different types of loans to choose from based on your financial goals and situation. Let’s dive into the two main types: fixed-rate mortgage loans and adjustable-rate mortgage loans.

Fixed-Rate Mortgage Loans

Fixed-rate mortgage loans are the most traditional type of mortgage. Here, the interest rate remains the same throughout the entire loan term, providing predictability and stability for the borrower. Some examples of fixed-rate mortgage loans include:

- 30-year fixed-rate mortgage

- 15-year fixed-rate mortgage

- 10-year fixed-rate mortgage

Adjustable-Rate Mortgage Loans

Adjustable-rate mortgage loans, on the other hand, have interest rates that can fluctuate over time based on market conditions. These loans typically start with a lower initial interest rate compared to fixed-rate loans, making them attractive to some borrowers. However, the interest rate can change periodically, impacting monthly payments. It’s important to understand the features of adjustable-rate mortgage loans, including:

- Initial fixed-rate period

- Index and margin adjustments

- Interest rate caps

Conventional Mortgages

Conventional mortgages are home loans that are not guaranteed or insured by the federal government. Instead, they are backed by private lenders such as banks, credit unions, and mortgage companies.

Comparison with Government-Backed Mortgages

Conventional mortgages differ from government-backed mortgages, such as FHA loans or VA loans, in that they are not insured or guaranteed by the government. This means that lenders take on more risk with conventional mortgages, leading to potentially stricter eligibility requirements and higher interest rates.

Down Payment Requirements

- Conventional mortgages typically require a higher down payment compared to government-backed loans. While FHA loans may only require a down payment as low as 3.5%, conventional mortgages often require a down payment of at least 5% to 20% of the home’s purchase price.

- A larger down payment can help borrowers secure a better interest rate and avoid private mortgage insurance (PMI) costs.

- Borrowers with a down payment of less than 20% may be required to pay for PMI until they reach that threshold, adding to the overall cost of the loan.

Government-Backed Mortgages

When it comes to government-backed mortgages, there are a few options available for homebuyers who may not qualify for a conventional loan. These types of mortgages are insured by government agencies, which reduces the risk for lenders and makes it easier for borrowers to secure financing.

Government-backed mortgages include Federal Housing Administration (FHA) loans, Veterans Affairs (VA) loans, and United States Department of Agriculture (USDA) loans. Each of these options has specific eligibility criteria and benefits that cater to different types of borrowers.

FHA Loans

FHA loans are popular among first-time homebuyers and those with less than perfect credit. The eligibility criteria for an FHA loan include a minimum credit score of 580, a down payment as low as 3.5%, and proof of steady income. Borrowers must also pay mortgage insurance premiums to protect the lender in case of default.

VA Loans

VA loans are exclusively available to active-duty service members, veterans, and eligible surviving spouses. The eligibility criteria for a VA loan include meeting the service requirements, obtaining a Certificate of Eligibility, and maintaining a satisfactory credit history. VA loans offer benefits such as no down payment requirement, competitive interest rates, and no private mortgage insurance.

USDA Loans

USDA loans are designed to help low to moderate-income borrowers in rural areas achieve homeownership. The eligibility criteria for a USDA loan include meeting income requirements, purchasing a home in an eligible rural area, and having a decent credit history. USDA loans offer benefits such as no down payment requirement and lower mortgage insurance costs compared to other loan options.

Jumbo Loans

Jumbo loans are mortgages that exceed the conforming loan limits set by Fannie Mae and Freddie Mac. These loans are used when the amount needed to purchase a home exceeds the maximum limit for conventional mortgages.

Differences between Conforming Loans and Jumbo Loans

Conforming loans adhere to the guidelines set by Fannie Mae and Freddie Mac, while jumbo loans do not. Jumbo loans typically have higher interest rates and stricter requirements because they are considered riskier for lenders due to their larger loan amounts.

Qualifying for a Jumbo Loan

- Higher Credit Score: Lenders usually require a higher credit score for jumbo loans, typically above 700.

- Larger Down Payment: Borrowers may need to put down a larger down payment, often 20% or more of the home’s purchase price.

- Lower Debt-to-Income Ratio: Lenders may require a lower debt-to-income ratio to ensure borrowers can afford the larger loan amount.

- Reserve Requirements: Borrowers may need to have a certain amount of cash reserves to cover mortgage payments in case of financial hardship.

Fixed-Rate Mortgages

Fixed-rate mortgages have a set interest rate that remains constant throughout the entire term of the loan. This means your monthly payments will stay the same, providing predictability and stability.

How Fixed-Rate Mortgages Work

Fixed-rate mortgages work by locking in an interest rate at the beginning of the loan term. This rate will not change, regardless of any fluctuations in the market. As a result, borrowers can budget more effectively since they know exactly how much their monthly payments will be.

Advantages of Choosing a Fixed-Rate Mortgage

- Stability: With fixed monthly payments, borrowers can easily predict housing costs.

- Protection from Rate Increases: If interest rates rise, your fixed-rate mortgage will remain the same.

- Long-Term Planning: Ideal for those who plan to stay in their home for an extended period.

Pros and Cons of Fixed-Rate Mortgages

- Pros:

- Cons:

Fixed monthly payments provide financial stability and predictability.

Protection from rising interest rates, especially in a high-rate environment.

Easy budgeting for the long term.

If interest rates drop, you won’t benefit unless you refinance.

Initial interest rates may be slightly higher compared to adjustable-rate mortgages.

Less flexibility compared to other types of mortgages.

Adjustable-Rate Mortgages (ARMs)

Adjustable-Rate Mortgages (ARMs) are a type of mortgage loan where the interest rate can change periodically. This is in contrast to Fixed-Rate Mortgages, where the interest rate remains the same for the entire loan term.

Interest Rate Changes in ARMs

In ARMs, the interest rates are typically tied to an index, such as the prime rate or the LIBOR rate. The interest rate can adjust at specific intervals, such as annually or every few years, based on the performance of the chosen index. This means that your monthly mortgage payments can increase or decrease depending on how the index changes.

- When the interest rate increases, your monthly payments will go up.

- Conversely, if the interest rate decreases, your monthly payments will decrease as well.

Benefits and Risks of ARMs

- Benefits:

- Lower initial interest rates compared to fixed-rate mortgages, which can result in lower initial monthly payments.

- May benefit borrowers who plan to sell or refinance before the initial fixed-rate period ends.

- Risks:

- Monthly payments can increase significantly if interest rates rise, leading to financial strain.

- Uncertainty about future interest rate changes can make budgeting challenging.