Debt repayment strategies are the key to unlocking financial success. From the snowball method to debt consolidation, understanding these approaches can pave the way to a debt-free future. Get ready to dive into the world of managing debt with style and finesse.

Let’s explore the ins and outs of different debt repayment strategies and how they can change the game when it comes to taking control of your finances.

Debt Repayment Strategies

Having a structured debt repayment plan is crucial because it helps individuals manage their debts effectively, stay organized, and work towards financial freedom.

Importance of a Structured Plan

A structured debt repayment plan provides a clear roadmap for individuals to follow, ensuring that they make consistent payments towards their debts and avoid missing deadlines. This can help improve credit scores and overall financial well-being.

Common Challenges

- High-interest rates: Many people struggle with high-interest rates, which can make it challenging to pay off debts quickly.

- Limited income: Some individuals face the challenge of having a limited income, making it difficult to allocate enough funds towards debt repayment.

- Lack of budgeting skills: Without proper budgeting skills, individuals may find it hard to prioritize debt repayment and may overspend in other areas.

Benefits of Different Strategies

Using different debt repayment strategies based on individual financial situations can help tailor the approach to fit specific needs and goals.

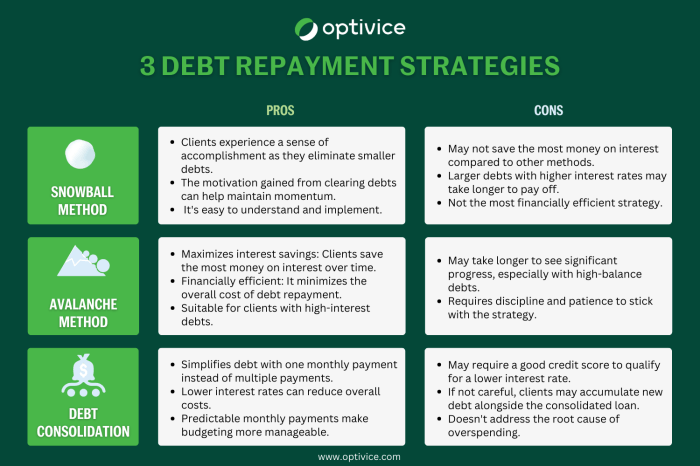

- Avalanche method: This strategy focuses on paying off debts with the highest interest rates first, helping individuals save money on interest payments in the long run.

- Snowball method: The snowball method involves paying off debts with the smallest balances first, providing a sense of accomplishment and motivation to continue debt repayment.

- Debt consolidation: Consolidating debts into a single loan with a lower interest rate can make repayment more manageable and streamlined.

Snowball Method

The snowball method is a debt repayment strategy where you prioritize paying off your smallest debts first while making minimum payments on larger debts. Once the smallest debt is paid off, you move on to the next smallest debt, creating a snowball effect that helps you gain momentum and motivation in paying off your debts.

How the Snowball Method Works

- List all your debts from smallest to largest.

- Allocate extra funds to pay off the smallest debt while making minimum payments on all other debts.

- Once the smallest debt is paid off, roll over the amount you were paying on that debt to the next smallest debt.

- Repeat this process until all debts are paid off.

Examples of Implementing the Snowball Method

- Let’s say you have three debts: $500, $1,000, and $2,000. You allocate extra funds to pay off the $500 debt first while making minimum payments on the others. Once the $500 debt is cleared, you move on to the $1,000 debt, using the funds you were using to pay off the $500 debt. This process continues until you are debt-free.

- Another example is if you receive a bonus or tax refund, you can use that extra money to pay off a chunk of your smallest debt, accelerating the snowball effect.

Comparison with Other Debt Repayment Strategies

- The snowball method focuses on small victories by paying off smaller debts first, providing motivation to tackle larger debts. In contrast, the avalanche method prioritizes debts with the highest interest rates, saving money on interest in the long run.

- While the snowball method may not save you as much money on interest compared to the avalanche method, its psychological benefits of quick wins and motivation can be more effective for some individuals in sticking to their debt repayment plan.

Avalanche Method

The avalanche method is a debt repayment strategy where you focus on paying off the debt with the highest interest rate first, while making minimum payments on all other debts. Once the debt with the highest interest rate is paid off, you move on to the next highest interest rate debt, and so on.

Key Differences Between Avalanche and Snowball Methods

- In the avalanche method, you prioritize debts based on interest rates, while the snowball method prioritizes debts based on balance size.

- The avalanche method may save you more money in interest payments compared to the snowball method.

- The snowball method provides quick wins by paying off smaller debts first, which can help boost motivation.

Tips on Deciding Between Avalanche and Snowball Methods

- If you want to save more money in interest payments over the long run, the avalanche method may be the right choice for you.

- If you need quick wins and motivation to keep you going, the snowball method could be more suitable.

- Consider your financial situation and personal preferences to determine which method aligns best with your goals and needs.

Debt Consolidation

When it comes to managing multiple debts, debt consolidation can be a helpful strategy. Debt consolidation involves combining all of your debts into a single loan, ideally with a lower interest rate, to make it easier to manage and pay off.

Debt consolidation can help in repayment by simplifying your finances. Instead of juggling multiple payments and due dates, you only have to worry about one monthly payment. This can reduce the chances of missing payments and incurring late fees, ultimately helping you pay off your debts more efficiently.

Advantages of Debt Consolidation

- Lower interest rates: By consolidating your debts, you may be able to secure a lower interest rate, saving you money in the long run.

- Simplified payments: With a single monthly payment, it’s easier to stay organized and on top of your debt repayment.

- Potential for lower monthly payments: Debt consolidation can sometimes result in a lower monthly payment, making it more manageable for your budget.

Disadvantages of Debt Consolidation

- Extended repayment period: While lower monthly payments can be beneficial, extending the repayment period may mean paying more in interest over time.

- Need for collateral: Some debt consolidation options may require collateral, such as a home equity loan, putting your assets at risk.

- Not addressing underlying issues: Debt consolidation is a tool for managing debt, but it doesn’t address the root cause of overspending or financial mismanagement.

Suitable Situations for Debt Consolidation

- High-interest credit card debt: If you have multiple credit card debts with high-interest rates, consolidating them into a single loan with a lower rate can save you money.

- Medical bills or unexpected expenses: If you’re facing a sudden influx of medical bills or unexpected expenses, consolidating your debts can provide relief and a structured repayment plan.

- Multiple student loans: Consolidating multiple student loans into a single loan can simplify repayment and potentially lower your interest rate.