Kicking off with home equity loans vs lines of credit, this opening paragraph is designed to captivate and engage the readers. Exploring the differences between these two financial options, we delve into the world of home equity and lines of credit, breaking down the key points for a clearer understanding.

As we navigate through the details of eligibility criteria, purposes, interest rates, benefits, risks, and more, you’ll gain valuable insights into which option may be best suited for your financial needs.

Key Differences

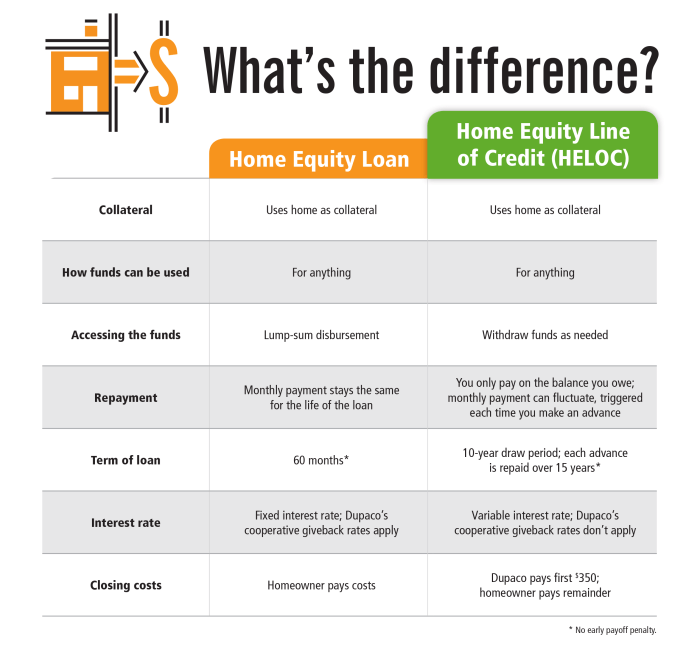

When it comes to home equity loans and lines of credit, there are some key differences that borrowers need to understand before making a decision. Let’s break it down:

Loan Structure

Home equity loans are typically a lump sum of money borrowed against the equity in your home, with a fixed interest rate and set monthly payments. On the other hand, lines of credit provide you with a revolving credit line that you can draw from as needed, with variable interest rates and minimum monthly payments.

Usage Flexibility

With a home equity loan, you receive the full loan amount upfront, making it ideal for one-time expenses like home renovations or debt consolidation. Lines of credit, on the other hand, offer more flexibility as you can borrow only what you need when you need it, making it suitable for ongoing or unpredictable expenses.

Interest Rates

Home equity loans typically have lower interest rates compared to lines of credit since they are secured by your home. Lines of credit may have variable rates that can fluctuate over time, potentially resulting in higher overall costs.

Eligibility Criteria

To qualify for a home equity loan, lenders usually require a minimum credit score, sufficient equity in your home, and a stable income. Lines of credit may have similar requirements but could be more lenient since they are revolving credit accounts.

Repayment Terms

Home equity loans have a fixed repayment term, usually ranging from 5 to 30 years, with predictable monthly payments. Lines of credit have more flexible repayment terms, allowing you to make interest-only payments or pay off the balance in full at any time.

Risk Level

While both options use your home as collateral, home equity loans pose a higher risk of foreclosure if you default on payments since they are structured as a traditional loan. Lines of credit offer more flexibility in terms of repayment, but failing to repay could still result in losing your home.

Purpose and Usage

When it comes to home equity loans and lines of credit, understanding their purpose and usage is key for making the right financial decision. Let’s break it down for you!

Common Purposes for Home Equity Loans

Home equity loans are often chosen by individuals for big-ticket items like home renovations, debt consolidation, or major expenses. Since these loans provide a lump sum of money upfront, they are ideal for projects with a fixed cost.

Utilization of Lines of Credit by Homeowners

Lines of credit, on the other hand, are more flexible and can be used for various purposes. Homeowners typically use lines of credit for ongoing expenses, emergencies, or even as a safety net for unforeseen costs. With a line of credit, you have access to funds as needed, making it a versatile financial tool.

Suitability Scenarios

– If you’re planning a specific renovation project with a fixed budget, a home equity loan might be the better option as it provides a lump sum upfront.

– On the other hand, if you want a financial safety net for unpredictable expenses or ongoing projects, a line of credit can be more suitable due to its flexibility.

Remember, understanding your financial goals and needs is crucial in determining whether a home equity loan or a line of credit is the right choice for you. Make sure to weigh the pros and cons of each option before making a decision!

Interest Rates and Terms

When it comes to interest rates and terms for home equity loans versus lines of credit, there are some key differences to consider.

Interest Rates for Home Equity Loans

Home equity loans typically come with fixed interest rates, meaning your rate stays the same throughout the life of the loan. This can provide stability and predictability in your monthly payments.

Variations in Interest Rates for Lines of Credit

Lines of credit, on the other hand, often come with variable interest rates. This means that your rate can fluctuate based on market conditions, which can lead to uncertainty in your payments.

Repayment Terms

In terms of repayment terms, home equity loans usually have a set repayment schedule with fixed monthly payments over a specific period of time. Lines of credit, however, offer more flexibility as you can borrow and repay funds as needed, similar to a credit card.

Overall, understanding the differences in interest rates and terms between home equity loans and lines of credit can help you decide which option best suits your financial needs.

Benefits and Risks

When it comes to choosing between a home equity loan and a home equity line of credit, there are various benefits and risks to consider. Let’s take a look at the potential advantages of opting for a home equity loan, the risks associated with choosing a home equity line of credit, and strategies for mitigating these risks.

Benefits of Home Equity Loan

- Fixed interest rates provide predictability in monthly payments.

- Lump sum payment can be beneficial for large expenses like home renovations or debt consolidation.

- Interest may be tax-deductible if used for home improvements.

- Option to choose longer repayment terms for lower monthly payments.

Risks of Home Equity Line of Credit

- Variable interest rates can lead to fluctuating monthly payments.

- Temptation to continuously borrow against the equity in your home, potentially leading to higher debt.

- Risk of foreclosure if unable to make payments on the borrowed amount.

- Possible fees for accessing funds, such as annual maintenance fees or transaction fees.

Strategies for Mitigating Risks

- Monitor interest rate changes and consider converting to a fixed-rate loan if rates rise.

- Set a strict budget and avoid using a home equity line of credit for unnecessary expenses.

- Create an emergency fund to cover unexpected financial setbacks and prevent defaulting on payments.

- Compare offers from different lenders to find the most favorable terms and fees.