Diving into the world of creating a personal budget, get ready to embark on a journey towards financial empowerment and control. From understanding the basics to managing debt and savings, this guide will equip you with the tools you need to take charge of your finances like a boss.

Let’s break down the steps and strategies that will help you pave the way to a more secure financial future.

Understanding the Basics of Budgeting

Creating a personal budget is essentially a financial plan that Artikels your income and expenses. It helps you track where your money is coming from and where it’s going.

Importance of Creating a Budget

A personal budget is crucial for managing your finances effectively. It allows you to have control over your money and make informed decisions about your spending habits.

Benefits of Having a Well-Defined Budget

- Helps you prioritize your spending and focus on what truly matters to you.

- Allows you to save for future goals and emergencies.

- Provides a clear picture of your financial health and helps you identify areas where you can cut back on expenses.

- Reduces stress and anxiety related to money by giving you a sense of security and control.

Setting Financial Goals

Setting financial goals before creating a budget is crucial for achieving financial success. By identifying your objectives, you can tailor your budget to align with your priorities and aspirations. This helps you stay motivated and disciplined in managing your finances effectively.

Types of Financial Goals

- Short-term Goals: These are goals that can be achieved within a year, such as building an emergency fund or saving for a vacation.

- Medium-term Goals: These goals typically have a timeline of 1-5 years, like buying a car or saving for a down payment on a house.

- Long-term Goals: Long-term goals span over 5 years and include objectives like retirement planning, investing in education, or purchasing a home.

Importance of Setting Financial Goals

Setting financial goals provides you with a roadmap for your financial journey. It helps you prioritize your spending, save more effectively, and make informed decisions when it comes to managing your money. By clearly defining your goals, you can track your progress, stay focused, and make adjustments to your budget as needed.

Tracking Income and Expenses

When it comes to managing your personal budget, tracking your income and expenses is crucial. By keeping a close eye on your earnings and spending, you can make informed financial decisions and stay on top of your financial goals.

Tracking Income Sources

- Keep detailed records of all sources of income, including paychecks, side hustles, investment returns, and any other money coming in.

- Use budgeting apps or spreadsheets to categorize and track your income sources for better organization.

- Regularly review your income to ensure you are meeting your financial needs and identify any opportunities to increase your earnings.

Tracking Expenses Effectively

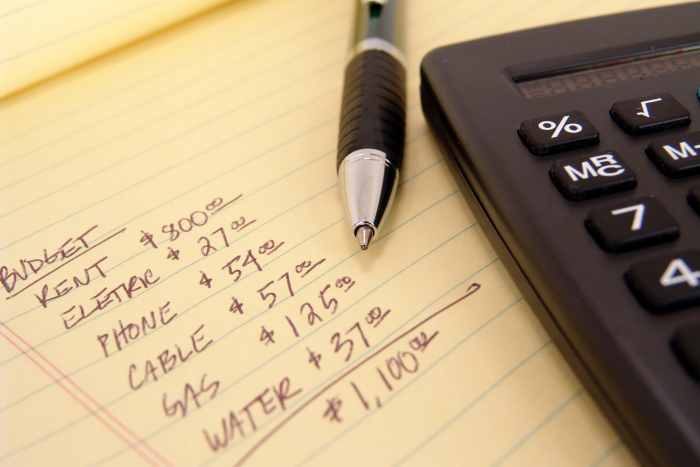

- Maintain a detailed list of all your expenses, from fixed costs like rent and utilities to variable expenses like groceries and entertainment.

- Consider using cash envelopes or digital tools to allocate funds for different spending categories and monitor your expenses in real-time.

- Track your spending habits over time to identify areas where you can cut back and save more money.

Importance of Accurately Monitoring Income and Expenses

- Ensures you are living within your means and not overspending.

- Helps you identify trends in your financial behavior and make necessary adjustments.

- Allows you to set realistic financial goals based on your actual income and expenses.

Creating Categories and Allocating Funds

Creating categories and allocating funds in your budget is essential to ensure that you are managing your money effectively. By categorizing your expenses, you can track where your money is going and make adjustments as needed. Allocating funds to each category helps you prioritize your spending and stay on track with your financial goals.

Categorizing Expenses in a Budget

When categorizing expenses in a budget, it’s important to group similar expenses together. This makes it easier to see where your money is being spent and identify areas where you may need to cut back. Common budget categories include:

- Housing: Rent or mortgage payments, utilities, maintenance

- Transportation: Car payments, gas, public transportation

- Food: Groceries, dining out

- Debt Payments: Credit card bills, student loans

- Entertainment: Movies, concerts, hobbies

- Savings: Emergency fund, retirement savings

Significance of Allocating Funds to Each Category

Allocating funds to each category helps you prioritize your spending based on your needs and financial goals. By setting aside a specific amount for each category, you can ensure that you have enough money allocated for essentials like housing and food, while also budgeting for savings and entertainment. This helps prevent overspending in one category at the expense of another, and allows you to make informed decisions about where your money should go each month.

Managing Debt and Savings

When it comes to managing debt and savings within your personal budget, it’s crucial to find a balance that works for your financial goals and priorities. Debt can be overwhelming, but with the right strategies, you can tackle it while still building up your savings for the future.

Managing Debt

- Start by prioritizing high-interest debt: Focus on paying off debts with the highest interest rates first to save money in the long run.

- Consider debt consolidation: Consolidating multiple debts into one lower-interest loan can make it easier to manage and potentially reduce your monthly payments.

- Avoid taking on new debt: Try to limit new debt while you work on paying off existing balances to prevent further financial strain.

Importance of Savings

- Emergency fund: Having savings set aside for unexpected expenses can prevent you from going further into debt during tough times.

- Future goals: Saving for big purchases, retirement, or other long-term goals can provide financial security and peace of mind.

- Opportunity fund: Savings can also give you the flexibility to take advantage of opportunities like investments or travel without relying on credit.

Balancing Debt Payments and Savings

- Allocate a portion of your income to both debt payments and savings: Prioritize making minimum payments on debts while also contributing to your savings goals.

- Adjust as needed: As you pay off debts or reach savings milestones, reassess your budget to see if you can increase payments or contributions.

- Automate payments: Set up automatic transfers for debt payments and savings to ensure consistency and avoid missed payments.

Reviewing and Adjusting the Budget

Regularly reviewing a personal budget is crucial to ensure that it remains effective and aligns with your financial goals. By monitoring your budget consistently, you can make necessary adjustments to stay on track and adapt to any changes in your financial situation.

Steps for Adjusting the Budget

- Track your expenses: Keep a record of all your expenses to identify any areas where you may be overspending.

- Review your income: Make sure your income sources are accurately reflected in your budget to determine if there are any discrepancies.

- Identify areas for cuts: Look for expenses that can be reduced or eliminated to free up funds for other financial goals.

- Allocate funds strategically: Adjust your budget categories to prioritize essential expenses and savings goals.

Benefits of Being Flexible with Budget Adjustments

- Adaptability: Being open to adjusting your budget allows you to respond to unexpected financial changes.

- Financial stability: By regularly reviewing and adjusting your budget, you can maintain control over your finances and avoid potential pitfalls.

- Goal achievement: Flexibility in budget adjustments can help you stay on course to reach your financial goals, even in the face of challenges.