Get ready to dive into the world of financial decision making, where every choice counts and every dollar matters. From personal finances to big business moves, this topic is a rollercoaster ride of highs and lows, twists and turns.

Whether you’re a savvy investor or just starting out, understanding the ins and outs of financial decision making is crucial for building a secure financial future. So buckle up and let’s explore the exciting realm of money moves.

Importance of Financial Decision Making

Making informed financial decisions is crucial for both individuals and businesses to secure their financial well-being and achieve their goals. It involves analyzing various options, considering risks and benefits, and choosing the best course of action to manage finances effectively.

Financial decision making impacts individuals by determining their ability to save, invest, and plan for the future. For example, choosing to save money for retirement instead of spending it on unnecessary items can lead to a more secure financial future. On the other hand, making impulsive purchases or taking on excessive debt can result in financial strain and limited opportunities in the long run.

Similarly, businesses rely on sound financial decision making to optimize profits, manage expenses, and plan for growth. For instance, investing in new technology to improve efficiency can lead to increased productivity and competitiveness in the market. However, failing to budget properly or ignoring financial risks can result in cash flow problems, bankruptcy, or even closure.

Poor financial decisions can have negative consequences such as debt accumulation, missed investment opportunities, credit score damage, and financial instability. For individuals, this could mean struggling to make ends meet, facing foreclosure, or being unable to retire comfortably. For businesses, it could result in layoffs, loss of market share, or even business failure.

In conclusion, the importance of financial decision making cannot be overstated. By making informed choices and prioritizing financial health, individuals and businesses can secure a stable and prosperous future.

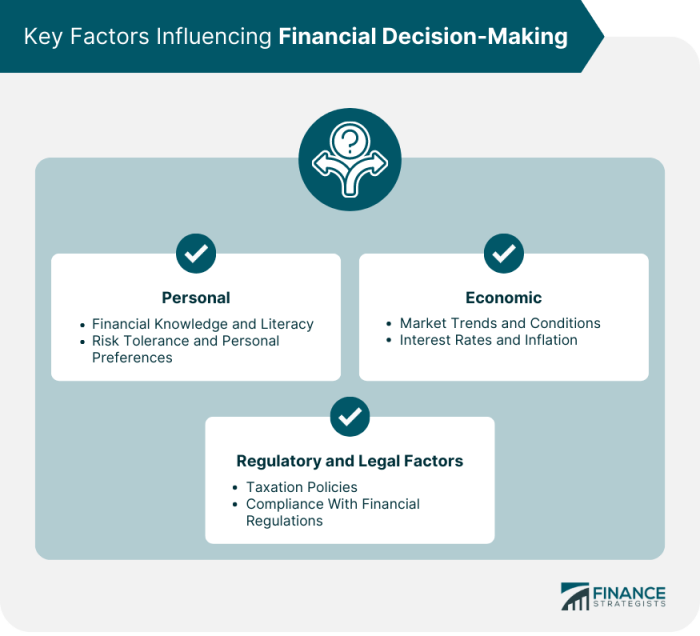

Factors Influencing Financial Decision Making

When it comes to making financial decisions, there are various internal and external factors that can influence the choices we make. Understanding these factors is crucial in making informed and effective decisions.

Internal factors that affect financial decision making include personal values and goals. Our individual values and long-term objectives play a significant role in determining how we manage our finances. For example, someone who prioritizes saving for retirement may make different decisions than someone who values immediate gratification through spending.

External factors, such as economic conditions and market trends, also have a big impact on financial decisions. Economic factors like inflation, interest rates, and employment levels can affect our financial choices. Market trends, such as the performance of stocks or real estate, can influence investment decisions.

Another important factor in financial decision making is risk tolerance. Risk tolerance refers to an individual’s willingness to take on financial risk in exchange for potentially higher returns. Understanding your risk tolerance is crucial in making investment decisions and creating a balanced portfolio.

Role of Risk Tolerance

Risk tolerance plays a crucial role in financial decision making. It determines how much risk an individual is comfortable with when investing or making other financial choices. Understanding your risk tolerance can help you make decisions that align with your financial goals and comfort level.

- Higher risk tolerance may lead to more aggressive investment strategies, potentially resulting in higher returns.

- Lower risk tolerance may lead to more conservative investment choices, with a focus on capital preservation.

- It’s important to assess your risk tolerance regularly, especially as your financial goals and circumstances evolve.

Strategies for Effective Financial Decision Making

Effective financial decision making involves a combination of setting clear financial goals, budgeting wisely, and understanding opportunity costs.

Setting Financial Goals

Setting financial goals is a crucial step in guiding your decision-making process. By clearly defining what you want to achieve financially, whether it’s saving for a house, paying off debt, or investing for retirement, you give yourself a roadmap to follow.

- Identify short-term and long-term financial goals.

- Make sure your goals are specific, measurable, achievable, relevant, and time-bound (SMART).

- Regularly review and adjust your goals as needed.

The Importance of Budgeting

Budgeting is essential for making sound financial decisions because it helps you track your income and expenses, prioritize your spending, and avoid unnecessary debt.

- Create a monthly budget that Artikels your income and expenses.

- Allocate a portion of your income towards savings and investments.

- Monitor your budget regularly and make adjustments as needed.

Understanding Opportunity Cost

Opportunity cost refers to the potential benefits that you miss out on when choosing one alternative over another. It is a critical concept in decision making because it forces you to consider the value of the next best alternative.

For example, if you choose to spend money on a new car, the opportunity cost could be the money you could have invested in the stock market instead.

Behavioral Biases and Financial Decision Making

Behavioral biases play a significant role in influencing financial decision making. These biases are often rooted in our emotions and cognitive processes, leading to irrational choices that can impact our financial well-being.

Common Behavioral Biases

- Confirmation Bias: People tend to seek out information that confirms their pre-existing beliefs, ignoring contradictory evidence that could lead to better financial decisions.

- Loss Aversion: The fear of losing money can lead individuals to make overly conservative investment choices, missing out on potential gains.

- Overconfidence Bias: Some individuals may overestimate their abilities to predict outcomes in the financial markets, leading to excessive risk-taking.

Emotions and Financial Decisions

Our emotions, such as fear and greed, can heavily influence our financial decisions. Fear of losing money might prevent us from taking necessary risks for growth, while greed can lead to reckless investments in pursuit of quick profits.

Cognitive Biases and Irrational Choices

- Anchoring Bias: People tend to rely heavily on the first piece of information they receive when making decisions, even if it’s irrelevant to the situation at hand.

- Availability Heuristic: This bias occurs when people make decisions based on readily available information, often overlooking more important factors.

- Herding Behavior: Following the crowd without conducting proper research can lead to poor financial decisions, as trends may not always reflect the best choices.