Strategies for negotiating financial terms sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

Get ready to dive into the world of financial negotiations, where understanding key terms, building trust, and creating win-win solutions are essential for navigating the complex terrain of deals and agreements.

Understanding Financial Terms

Understanding financial terms is crucial when negotiating deals or contracts. It allows both parties to communicate effectively and ensures that everyone is on the same page when it comes to financial matters.

Key Financial Terms

- Interest Rate: The percentage charged by a lender for the use of their money.

- Principal: The initial amount of money borrowed or invested.

- Amortization: The process of paying off a debt through regular payments over time.

- ROI (Return on Investment): The profitability of an investment, calculated as a percentage of the initial investment.

Importance of Comprehending Financial Jargon

- Prevents Misunderstandings: Knowing financial terms helps avoid confusion and ensures clarity in negotiations.

- Makes Informed Decisions: Understanding jargon allows individuals to make educated decisions based on financial implications.

- Builds Credibility: Being well-versed in financial terms enhances credibility and professionalism in negotiations.

Commonly Misunderstood Financial Terms

- APR (Annual Percentage Rate): Often confused with interest rate, APR includes additional fees and charges, giving a more accurate picture of borrowing costs.

- Liquid Assets: Cash or assets that can be easily converted into cash, but not all assets are considered liquid.

- Net Worth: The total value of an individual’s assets minus liabilities, representing their overall financial health.

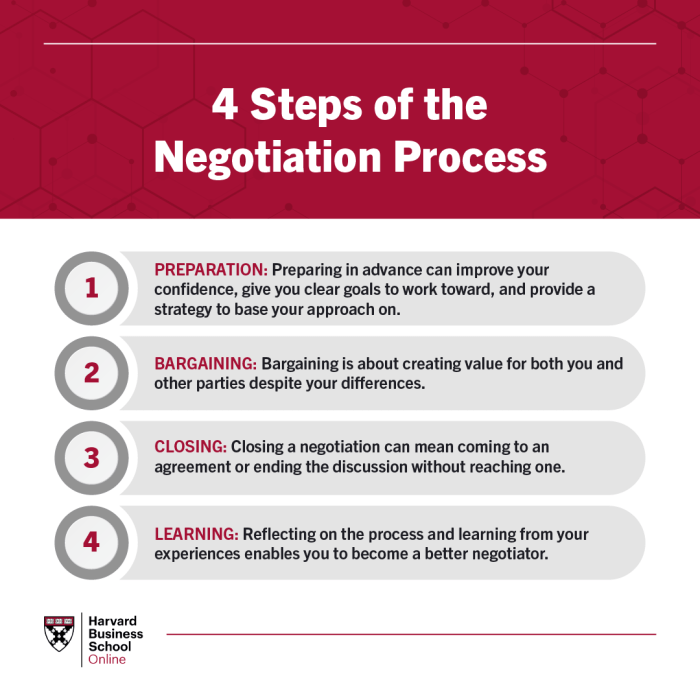

Preparation for Negotiations

Before diving into negotiations over financial terms, it is crucial to be well-prepared. This involves conducting thorough research, gathering necessary documents, and setting clear objectives and limits to guide the negotiation process.

Research Before Negotiating

Research plays a vital role in successful negotiations. It is essential to gather information about the financial terms, market trends, competitor strategies, and industry standards. This knowledge will empower you to make informed decisions and negotiate from a position of strength.

Checklist of Documents

- Financial statements: Income statements, balance sheets, cash flow statements

- Contracts: Any existing contracts related to the financial terms being negotiated

- Market research: Data on market trends, competitor pricing, and industry benchmarks

- Legal documents: Any legal agreements or regulations that may impact the negotiation

Setting Clear Objectives and Limits

Before entering negotiations, it is essential to define your objectives and limits. Clearly Artikel what you hope to achieve from the negotiation and what your bottom line is. Setting these parameters will help you stay focused and prevent you from making impulsive decisions during the negotiation process.

Building Rapport and Trust

Establishing rapport and trust in financial negotiations is crucial for creating a positive and collaborative atmosphere between parties. It lays the foundation for open communication, mutual understanding, and reaching a successful agreement.

Strategies to Build Trust

Building trust with the other party involves demonstrating honesty, integrity, and reliability throughout the negotiation process. Here are some strategies to help build trust:

- Be transparent about your intentions and objectives.

- Listen actively to the other party’s concerns and perspectives.

- Follow through on commitments and deadlines.

- Show empathy and understanding towards the other party’s position.

- Acknowledge and address any issues or conflicts openly and constructively.

Impact of Trust on Negotiation Process

Trust plays a significant role in shaping the negotiation process and outcomes. When there is trust between parties, it leads to:

- Increased cooperation and collaboration.

- Enhanced communication and information sharing.

- Greater flexibility and willingness to compromise.

- Faster decision-making and problem-solving.

- Overall improved relationship and long-term partnership potential.

Creating Win-Win Solutions

When it comes to financial negotiations, creating win-win solutions is crucial for fostering positive and sustainable relationships between parties. A win-win solution means that both parties benefit from the agreement, leading to mutual satisfaction and long-term success. By exploring compromises and finding common ground, negotiators can reach agreements that are fair and beneficial for everyone involved.

Examples of Compromises

- Adjusting payment terms to accommodate both parties’ cash flow needs.

- Sharing risks and rewards to ensure that both sides have a stake in the outcome.

- Offering additional services or products to sweeten the deal for both parties.

Importance of Mutually Beneficial Agreements

Creating win-win solutions is essential because it builds trust and rapport between parties, setting the foundation for future collaborations. When both sides feel valued and respected in a negotiation, they are more likely to honor their commitments and work towards shared goals. By prioritizing fairness and cooperation, negotiators can strengthen their relationships and achieve sustainable success in the long run.

Effective Communication Strategies

Effective communication is crucial in financial negotiations as it can impact the outcome significantly. Clear and concise communication helps in understanding the terms and conditions, clarifying doubts, and building trust between parties involved.

Active Listening Tips

- Avoid interrupting the speaker and listen actively without formulating a response in your mind.

- Ask clarifying questions to ensure you understand the information correctly.

- Paraphrase what the other party has said to show that you are actively listening and to confirm your understanding.

- Maintain eye contact and nod to show that you are engaged in the conversation.

Role of Non-Verbal Communication

Non-verbal communication, such as body language and facial expressions, plays a significant role in conveying intentions during negotiations. It can either reinforce or contradict the verbal messages being communicated. It is essential to pay attention to non-verbal cues to understand the other party’s feelings and intentions accurately.

Handling Objections and Difficult Situations

When it comes to negotiating financial terms, objections and difficult situations are bound to arise. It’s crucial to be prepared and have strategies in place to address these challenges effectively.

Addressing Objections During Financial Negotiations

- Listen actively to understand the objection fully before responding.

- Acknowledge the objection and show empathy towards the other party’s concerns.

- Provide relevant information or data to counter the objection and support your position.

- Offer alternative solutions or compromises to find common ground.

- Stay calm and composed throughout the discussion to maintain professionalism.

Navigating Difficult Situations or Conflicts

- Take a break if emotions are running high to prevent escalating the conflict.

- Foster open communication and encourage both parties to express their concerns.

- Focus on finding mutually beneficial solutions rather than winning at all costs.

- Seek mediation or involve a neutral third party if the situation becomes too heated to handle alone.

Maintaining Professionalism and Composure Under Pressure

- Practice active listening and avoid interrupting the other party when tensions rise.

- Use positive language and tone to keep the conversation constructive and respectful.

- Take deep breaths and focus on the end goal of reaching a satisfactory agreement.

- Remain flexible and open-minded to explore different options for resolution.

Leveraging Power Dynamics

In financial negotiations, power dynamics play a crucial role in determining the outcome of the deal. Understanding how to leverage power effectively can give you an advantage without causing conflicts or damaging relationships.

Recognizing Power Dynamics

- Power can come from various sources such as knowledge, experience, authority, or control over resources.

- Identify the power dynamics at play by observing the behavior, communication, and decision-making patterns of the parties involved.

- Awareness of power imbalances can help you strategize your approach and responses during negotiations.

Leveraging Power Effectively

- Build credibility and establish yourself as an expert in your field to gain influence and respect.

- Use active listening to understand the other party’s needs and concerns, allowing you to tailor your approach accordingly.

- Highlight your strengths and unique selling points to showcase the value you bring to the negotiation table.

Responding to Power Plays

- Avoid getting intimidated by power plays and maintain your composure and professionalism.

- Stay focused on the end goal and the mutual benefits of reaching a successful agreement.

- Counter power plays with strategic moves such as offering alternatives, asking probing questions, or seeking clarification on ambiguous terms.