Diving into the realm of Financial tools for budgeting, this introduction sets the stage for a deep dive into the world of managing money like a pro. From tracking expenses to setting goals, these tools are the key to financial success.

Whether you’re a savvy spender or a budgeting newbie, understanding the ins and outs of financial tools can make a world of difference in your financial journey.

Importance of Financial Tools for Budgeting

Financial tools are essential for effective budgeting as they provide individuals and businesses with the necessary resources to track, manage, and analyze their finances in a structured manner. These tools enable users to set financial goals, monitor expenses, create budgets, and make informed decisions regarding their money.

Popular Financial Tools for Budgeting

- Mint: A free online tool that helps users track their spending, create budgets, and set financial goals.

- You Need A Budget (YNAB): Focuses on zero-based budgeting, where every dollar has a job, helping users allocate their money effectively.

- Personal Capital: Offers tools for investment tracking, retirement planning, and budgeting to provide a holistic view of an individual’s financial situation.

How Financial Tools Help Manage Finances Efficiently

Financial tools streamline the budgeting process by automating tasks such as categorizing expenses, generating reports, and providing insights into spending patterns. By using these tools, individuals and businesses can make informed decisions, identify areas for improvement, and ultimately achieve their financial goals more effectively.

Types of Financial Tools for Budgeting

When it comes to managing your money like a boss, having the right financial tools in your arsenal can make all the difference. Let’s dive into the different categories of financial tools available for budgeting and how they can help you stay on top of your finances.

Automated Budgeting Tools

Automated budgeting tools are like having a personal finance assistant at your fingertips. These tools sync with your bank accounts and credit cards to track your spending, categorize transactions, and even set budget goals for you. Apps like Mint, YNAB, and Personal Capital fall into this category, making budgeting a breeze with real-time updates and insights.

Manual Budgeting Methods

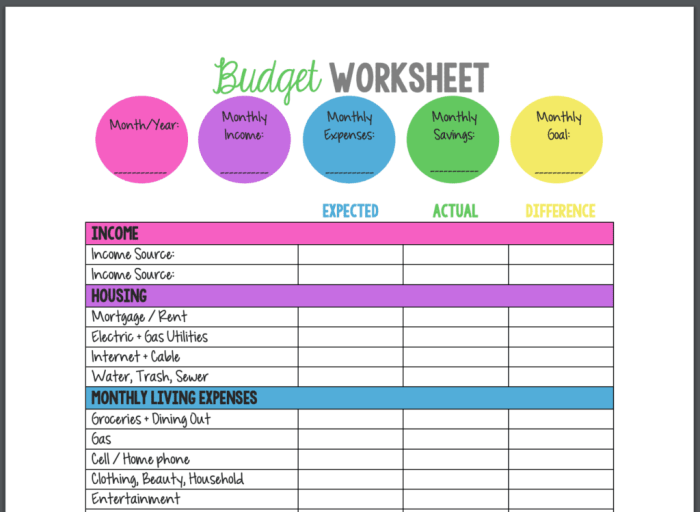

On the flip side, manual budgeting methods involve good old-fashioned pen and paper or spreadsheets. While it may require more time and effort, some people prefer the hands-on approach to budgeting. By manually inputting your income and expenses, you have full control over every aspect of your budget without relying on automated algorithms.

Specialized Financial Tools

Specialized financial tools cater to specific budgeting needs, such as debt payoff calculators, retirement planners, or investment trackers. These tools offer advanced features tailored to help you reach your financial goals faster and more efficiently. Whether you’re saving for a big purchase or planning for your future, specialized tools can provide the extra support you need to stay on track.

Features to Look for in Financial Tools

When choosing a financial tool for budgeting, it is important to consider key features that make the tool effective in helping you manage your finances efficiently. These features can vary from user interface design to security measures that protect your sensitive financial information.

User Interface and Customization Options

- Intuitive design: Look for a financial tool that has a user-friendly interface, making it easy to navigate and use without complicated instructions.

- Customizable categories: The ability to customize budget categories based on your specific financial goals and spending habits can help you track expenses more accurately.

- Visual representations: Tools that provide visual graphs or charts to represent your budget can help you understand your financial situation at a glance.

Security Measures

- Encryption: Ensure that the financial tool uses encryption to protect your data from unauthorized access or cyber threats.

- Two-factor authentication: Look for tools that offer two-factor authentication for an added layer of security when logging in.

- Regular updates: Choose a tool that receives regular updates to patch any security vulnerabilities and keep your information safe.

How to Choose the Right Financial Tool for Budgeting

Choosing the right financial tool for budgeting is crucial for managing your finances effectively. Follow these steps to evaluate and select the most suitable option for your individual or business needs.

Consider Cost, Compatibility, and Scalability

- Cost: Evaluate the pricing structure of different financial tools. Consider if it fits within your budget and offers good value for the features provided.

- Compatibility: Ensure that the financial tool is compatible with your devices and operating systems. It should sync seamlessly across all your platforms for easy access.

- Scalability: Think about the future growth of your finances. Choose a tool that can scale with your needs, whether you’re an individual looking to expand your budgeting capabilities or a business planning for growth.

Importance of Trial Periods or Demos

Before committing to a specific financial tool, take advantage of trial periods or demos. This allows you to test the features, interface, and overall usability of the tool before making a financial commitment. Make sure to explore all functionalities during this period to ensure it meets your requirements.