Diving into Real estate market trends, this intro sets the stage for a wild ride through the dynamic world of real estate, where trends shape the game and players must stay ahead of the curve.

In the following section, we’ll delve into the intricacies of real estate market trends, exploring what drives them and why they matter in the fast-paced industry.

Overview of Real Estate Market Trends

Real estate market trends refer to the patterns and changes in the housing market that can impact property values, supply and demand, and overall market conditions. These trends can be influenced by various factors such as economic conditions, interest rates, demographics, and government policies.

Understanding market trends is crucial for real estate professionals as it allows them to make informed decisions and adapt their strategies accordingly. By staying informed about the latest trends, professionals can anticipate shifts in the market, identify emerging opportunities, and mitigate risks.

Impact of Market Trends on Buying and Selling Decisions

- Market trends can influence pricing strategies, helping sellers determine the optimal listing price based on current market conditions.

- Buyers can use market trends to assess the timing of their purchase, taking advantage of favorable conditions such as low interest rates or high inventory levels.

- Understanding market trends can also help real estate professionals advise their clients on investment opportunities, property values, and potential risks in the market.

Factors Influencing Real Estate Market Trends

When it comes to the real estate market, several key factors play a crucial role in shaping trends. These factors can range from economic conditions to environmental concerns, as well as government policies that impact the overall landscape of the market.

Economic Factors vs. Environmental Factors

Economic factors such as interest rates, inflation, employment levels, and GDP growth have a significant impact on real estate market trends. For example, low-interest rates can stimulate demand for mortgages, leading to an increase in home purchases and subsequently driving up prices. On the other hand, environmental factors like natural disasters, climate change, and sustainability initiatives can also influence market trends. Properties in areas prone to flooding or extreme weather events may see a decrease in value, while eco-friendly homes with energy-efficient features are becoming more desirable.

Government Policies

Government policies play a crucial role in shaping real estate market trends. For instance, tax incentives for homeownership or real estate investments can stimulate demand and boost property values. On the other hand, regulations on land use, zoning laws, and building codes can impact the supply of housing and influence prices. Additionally, policies related to infrastructure development, transportation projects, or urban planning can also shape the demand for properties in specific locations.

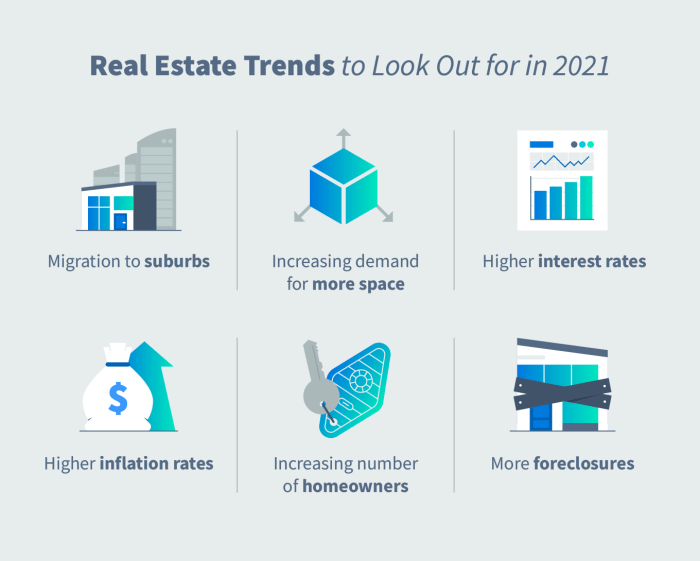

Emerging Trends in Real Estate Markets

The real estate market is constantly evolving, with new trends shaping the industry. Let’s take a look at some of the recent emerging trends that are influencing the real estate market.

Impact of Technology

Technology has revolutionized the real estate industry, making it more efficient and accessible. From virtual tours and online listings to digital signatures and blockchain transactions, technology has significantly impacted how real estate transactions are conducted. The use of artificial intelligence and big data analytics has also helped in making more informed decisions when it comes to buying or selling properties.

Changing Demographics

Changing demographics, such as the rise of millennials as a key demographic group, have influenced real estate trends. Millennials are looking for more sustainable and affordable housing options, leading to an increase in demand for eco-friendly and smart homes. Additionally, the aging population is driving the demand for age-friendly housing options and amenities.

Regional Variances in Real Estate Trends

When it comes to real estate market trends, one important aspect to consider is the regional variances that can greatly impact how the market behaves. Different regions can experience unique trends based on various factors such as population growth, economic conditions, and geographical location.

Urban, Suburban, and Rural Areas

Real estate trends can vary significantly between urban, suburban, and rural areas. Urban areas tend to have higher demand for properties due to population density and proximity to amenities, leading to higher property prices. Suburban areas, on the other hand, may see trends influenced by factors like commuting distance, school districts, and neighborhood developments. Rural areas often have slower-paced markets with more affordable housing options, appealing to those seeking a quieter lifestyle.

Case Studies

Let’s take a look at some case studies that highlight how regional factors can affect real estate market trends:

- In a bustling urban city like New York City, limited space and high demand drive property prices to skyrocket, making it a seller’s market with fierce competition among buyers.

- Conversely, in suburban areas like the outskirts of Atlanta, trends may be influenced by factors such as new infrastructure projects, leading to a rise in property values as accessibility improves.

- In rural regions such as the Midwest, trends can be impacted by agricultural developments, influencing the demand for farm properties and affecting overall market stability.

Impact of Global Events on Real Estate Market Trends

Global events such as pandemics or economic crises have a significant impact on real estate market trends. These events can cause shifts in demand, pricing, and investment strategies within the real estate sector.

Pandemics and Economic Crises

- During pandemics, the real estate market may experience a decrease in demand for commercial properties such as office spaces and retail stores.

- Investors may become more cautious, leading to a decrease in real estate transactions and a slowdown in new developments.

- On the other hand, economic crises can result in lower property prices, making it an opportune time for investors to acquire assets at a discount.

- Uncertainty in the global economy can also lead to a shift towards safer investments such as real estate, driving up demand in certain sectors.

Geopolitical Factors

- Geopolitical factors such as trade wars or conflicts can have a ripple effect on global real estate markets.

- Increased political instability in a region can deter foreign investment, impacting property values and market liquidity.

- Conversely, peace treaties or diplomatic agreements can boost investor confidence and stimulate real estate activity.

Navigating Market Trends During Global Uncertainty

- Investors can mitigate risks during times of global uncertainty by diversifying their real estate portfolios across different regions and asset classes.

- Staying informed about geopolitical developments and economic indicators can help investors make informed decisions in a volatile market.

- Adopting a long-term investment strategy and focusing on properties with stable cash flow can provide a buffer against short-term market fluctuations.

- Seeking guidance from real estate experts and leveraging technology for market analysis can also help investors navigate uncertain times with more confidence.