Dive into the world of financial planning software where possibilities are endless and financial goals are within reach. With a touch of American high school hip style, this narrative promises to be both informative and engaging.

Let’s explore the key features, automation, data security, customization, and integration aspects of financial planning software to understand how it can revolutionize the way we manage our finances.

Introduction to Financial Planning Software

Financial planning software is a digital tool designed to help individuals and businesses manage their finances more effectively. By utilizing advanced algorithms and data analysis, financial planning software offers a wide range of features to assist users in budgeting, investing, and planning for the future.

One of the primary purposes of financial planning software is to provide users with a comprehensive overview of their financial situation. This includes tracking income and expenses, monitoring investments, setting financial goals, and creating budgets. By centralizing all financial information in one place, users can make more informed decisions and optimize their financial strategies.

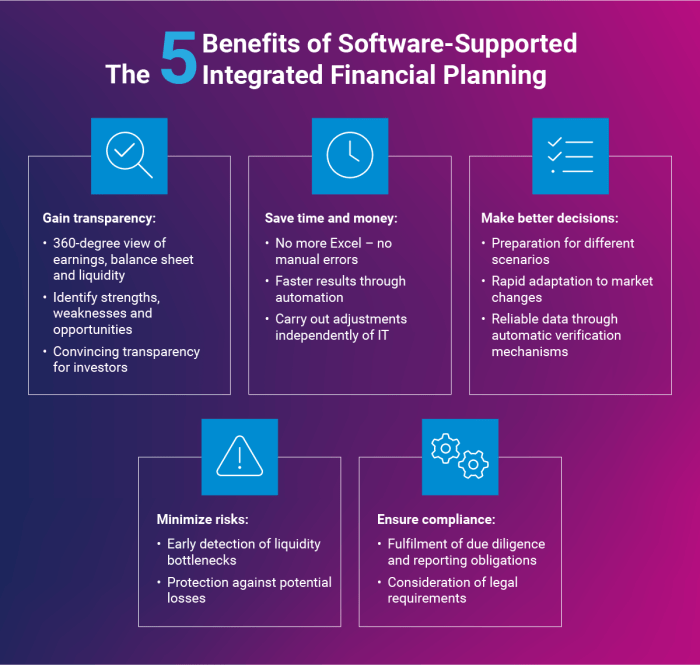

The benefits of using financial planning software are numerous. Not only does it save time by automating repetitive tasks and calculations, but it also helps users make better financial decisions by providing insights and recommendations based on their financial data. Additionally, financial planning software can help users identify potential risks, such as overspending or inadequate savings, and suggest ways to mitigate them.

Popular examples of financial planning software in the market include Mint, Quicken, and Personal Capital. These platforms offer a variety of tools and features to help users track their finances, analyze their spending habits, and plan for their financial future. Whether you are a beginner looking to get a better grip on your finances or a seasoned investor seeking to optimize your portfolio, financial planning software can be a valuable asset in achieving your financial goals.

Features of Financial Planning Software

Financial planning software comes equipped with a variety of features that can help users effectively manage their finances. These features are designed to streamline the financial planning process and provide users with valuable insights to make informed decisions about their money. Let’s take a closer look at some key features commonly found in financial planning software:

Budgeting Tools

- Allows users to create detailed budgets based on income and expenses.

- Tracks spending habits and provides alerts when going over budget.

- Helps users identify areas where they can cut costs and save money.

Investment Tracking

- Enables users to monitor their investment portfolios in real-time.

- Provides performance analysis and projections for investments.

- Offers tools for diversifying investments and minimizing risks.

Retirement Planning

- Calculates retirement savings goals based on user input and financial data.

- Estimates future retirement income and expenses.

- Helps users create a retirement savings plan and track progress towards their goals.

Debt Management

- Allows users to input and track all debts, including loans and credit card balances.

- Offers debt payoff calculators and strategies for reducing debt efficiently.

- Provides insights into interest rates and payment schedules to optimize debt repayment.

Automation and Efficiency

Financial planning software offers users a range of automated features that streamline the process of managing finances. By automating tasks such as budgeting, investment tracking, and goal setting, users can save time and effort while gaining valuable insights into their financial health.

Budgeting Automation

- Automated budgeting tools allow users to set spending limits for different categories and track their expenses in real-time.

- By automating the budgeting process, users can easily identify areas where they may be overspending and make adjustments accordingly.

- Automated alerts can notify users when they are approaching or exceeding their budget limits, helping them stay on track with their financial goals.

Investment Tracking Efficiency

- Financial planning software can automatically track investment performance, including gains and losses, to provide users with a comprehensive view of their portfolio.

- Users can easily monitor their investments and make informed decisions based on real-time data, without the need for manual tracking.

- Automation eliminates the need for manual data entry and reduces the risk of errors in investment tracking, ensuring accuracy and efficiency.

Goal Setting Simplification

- Automated goal-setting features allow users to set specific financial goals, such as saving for a vacation or retirement, and track their progress over time.

- Users can receive personalized recommendations and guidance on how to achieve their financial goals, making the process more manageable and effective.

- Automation streamlines the goal-setting process by providing users with actionable steps and monitoring their progress, ultimately helping them stay motivated and focused on their objectives.

Data Security and Privacy

In the world of financial planning software, data security and privacy are paramount.

Importance of Data Security

- Protecting sensitive financial information from cyber threats is crucial to prevent unauthorized access or breaches.

- Ensuring data privacy builds trust with users and instills confidence in the software’s reliability.

- Compliance with industry regulations like GDPR and PCI DSS is necessary to avoid legal repercussions.

Measures for Data Security

Software providers employ encryption techniques to safeguard user data, ensuring it remains confidential and secure.

- Implementing multi-factor authentication adds an extra layer of protection against unauthorized logins.

- Regular security audits and updates help identify and address vulnerabilities promptly.

- Data backup and recovery systems prevent loss of information in case of system failures or cyber attacks.

Comparison of Software Options

| Software | Data Security Features |

|---|---|

| Software A | End-to-end encryption, regular security audits |

| Software B | Multi-factor authentication, data backup and recovery |

| Software C | Compliance with industry regulations, secure data storage |

Customization and Personalization

Financial planning software offers a high level of customization and personalization to meet individual financial goals. Users can input their specific income, expenses, savings goals, and investment preferences to create a tailored financial plan.

Benefits of Personalized Recommendations

- Customized Goal Setting: Users can set personalized financial goals, such as saving for a house down payment or planning for retirement, and the software helps create a plan to achieve these goals.

- Personalized Insights: The software analyzes the user’s financial data and provides personalized insights and recommendations to optimize their financial strategy.

- Scenario Planning: Users can simulate different financial scenarios to understand the potential outcomes of their decisions, allowing for informed and personalized choices.

Enhanced User Experience through Customization

- Visual Dashboards: Customizable dashboards allow users to track their financial progress visually, making it easier to understand and stay motivated.

- Alerts and Notifications: Personalized alerts remind users of upcoming bills, savings targets, or investment opportunities, keeping them on track with their financial plan.

- Portfolio Customization: Users can tailor their investment portfolios based on their risk tolerance, time horizon, and financial goals, ensuring a personalized approach to wealth management.

Integration with Other Financial Tools

Financial planning software that integrates with other tools like banking apps, investment platforms, and accounting software offers numerous advantages to users. By seamlessly connecting these tools, users can enjoy a more comprehensive and efficient approach to managing their finances.

Streamlined Financial Management Processes

Integrating financial planning software with other tools streamlines financial management processes for users by allowing them to access all their financial information in one place. This eliminates the need to switch between multiple platforms, saving time and reducing the risk of errors in data entry.

- Users can view their bank account balances, investment portfolios, and budgeting information all in one dashboard, providing a holistic view of their financial health.

- Automatic syncing of data between different tools ensures that information is always up-to-date, eliminating the need for manual updates and reconciliation.

- Integration with accounting software allows for seamless tracking of income and expenses, simplifying tax preparation and financial reporting.

Examples of Successful Integrations

One example of a successful integration is the connection between a financial planning software and a banking app. Users can link their bank accounts to the financial planning software, enabling automatic categorization of transactions and real-time updates on account balances.

Another example is the integration of investment platforms with financial planning software. Users can sync their investment accounts to the software, allowing for a comprehensive overview of their investment performance and asset allocation.

These integrations have a significant impact on users’ financial planning by providing them with a more complete picture of their finances and simplifying the process of managing multiple financial accounts and assets.