Get ready to dive into the world of decoding stock quotes, where numbers and symbols come together to paint a picture of market trends and investment opportunities.

In this guide, we’ll break down the key components of a stock quote and unravel the mysteries behind stock prices, volume, and market indexes.

Understanding Stock Quotes

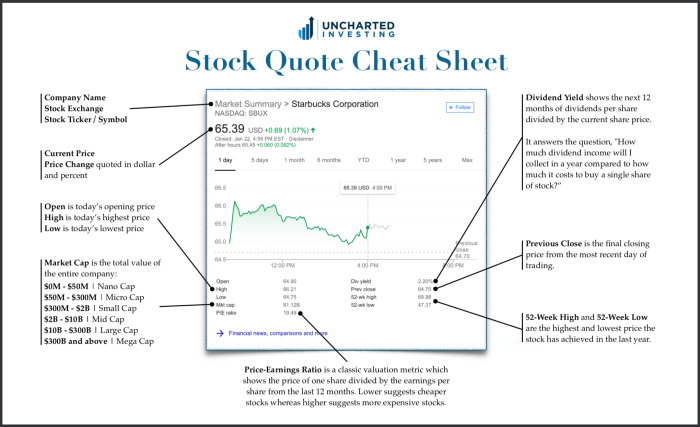

When looking at a stock quote, it’s important to understand the different components that make up the information provided. Each element serves a specific purpose in giving investors insight into the performance of a particular stock.

Components of a Stock Quote:

- Stock Symbol: This is a unique set of letters representing a specific company on the stock exchange. For example, AAPL is the symbol for Apple Inc.

- Price: This is the current price at which the stock is being traded. It reflects the supply and demand dynamics in the market.

- Volume: This shows the total number of shares that have been traded during a specific period, usually a day. It indicates the level of interest in the stock.

- Change: This is the difference in price from the previous day’s closing price. It shows whether the stock price has gone up or down.

- High/Low: These values represent the highest and lowest prices at which the stock has traded during a particular period, often a day or year.

Importance of Each Element:

- The stock symbol is crucial for identifying a specific company in the market.

- The price helps investors determine the value of a stock and make decisions on buying or selling.

- Volume indicates the level of activity and interest in a stock, which can influence price movements.

- The change in price gives insight into the stock’s recent performance and market sentiment.

- The high/low prices provide a range of where the stock has traded, helping investors assess potential risks and rewards.

Popular Stock Symbols and Quotes:

| Stock Symbol | Quote |

|---|---|

| AAPL | $145.11 |

| GOOGL | $2,738.62 |

| TSLA | $679.82 |

Interpreting Stock Prices

When looking at a stock quote, it’s important to understand how stock prices are displayed and what they represent. Stock prices are typically shown with different values, such as bid price, ask price, and last price.

Bid price refers to the highest price a buyer is willing to pay for a stock at a given moment. On the other hand, ask price represents the lowest price a seller is willing to accept for the stock. The last price, also known as the closing price, is the most recent price at which the stock was traded.

Stock Price Fluctuations

Stock prices can fluctuate throughout the trading day due to various factors such as market demand, economic news, and company performance. For example, if a company announces positive earnings results, the stock price may increase as more investors are interested in buying the stock. On the other hand, negative news or economic downturns can lead to a decrease in stock prices.

Overall, understanding how bid price, ask price, and last price work together can give investors valuable insights into the current state of the market and help them make informed decisions when buying or selling stocks.

Analyzing Stock Volume

When it comes to analyzing stock volume, it is essential to understand the significance of this metric in a stock quote. Stock volume refers to the total number of shares of a particular stock that are traded within a specific period, typically a day. It is a crucial indicator of market interest in a particular stock and can provide valuable insights into potential price movements.

Significance of Stock Volume

- High stock volume often indicates strong market interest in a particular stock. This increased activity can suggest that there is a significant amount of buying or selling happening, which may lead to price movements in the near future.

- Low stock volume, on the other hand, may indicate a lack of interest in a stock. This could mean that there is less trading activity, making it more challenging for investors to buy or sell shares at desired prices.

- Stock volume can also help investors identify trends in the market. For example, a sudden spike in volume accompanied by a price increase may signal a bullish trend, while a decrease in volume alongside a price drop could indicate a bearish trend.

Impact of Stock Volume on Stock Price Movements

- When stock volume is high, it can lead to increased volatility in stock prices. This is because a large number of buyers and sellers are actively participating in trading, causing prices to fluctuate more significantly.

- Conversely, low stock volume can result in price stagnation or limited price movements. With fewer trades taking place, there is less momentum to drive prices up or down, leading to a more stable stock price.

- In some cases, a divergence between stock price movements and volume trends can also provide valuable insights. For example, if stock prices are rising on decreasing volume, it may indicate a weakening trend and vice versa.

Understanding Stock Market Indexes

Stock market indexes play a crucial role in stock quotes as they provide a snapshot of the overall market performance. These indexes track the performance of a specific group of stocks, giving investors insight into how the market as a whole is doing.

S&P 500

The S&P 500 is one of the most widely followed stock market indexes, representing the performance of 500 large-cap U.S. companies. This index is often used as a benchmark for the overall health of the U.S. stock market.

Dow Jones Industrial Average

The Dow Jones Industrial Average, or simply the Dow, tracks the stock prices of 30 large U.S. companies. It is one of the oldest and most well-known stock market indexes, offering insight into the performance of key industrial sectors.

Nasdaq Composite

The Nasdaq Composite index focuses on technology and internet-related stocks, including both domestic and international companies. It is a key indicator of the performance of tech-heavy sectors in the market.

Overall, stock market indexes reflect the overall market performance by tracking the prices of a specific group of stocks. Investors use these indexes to gauge market trends, compare the performance of different sectors, and make informed investment decisions.