Comparing investment vehicles sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. From stocks to real estate, this exploration will provide a comprehensive look at the world of investment opportunities.

As we delve deeper into the various types of investment vehicles, factors to consider when choosing them, performance metrics, and costs and fees associated, get ready to expand your financial knowledge in a fun and engaging way.

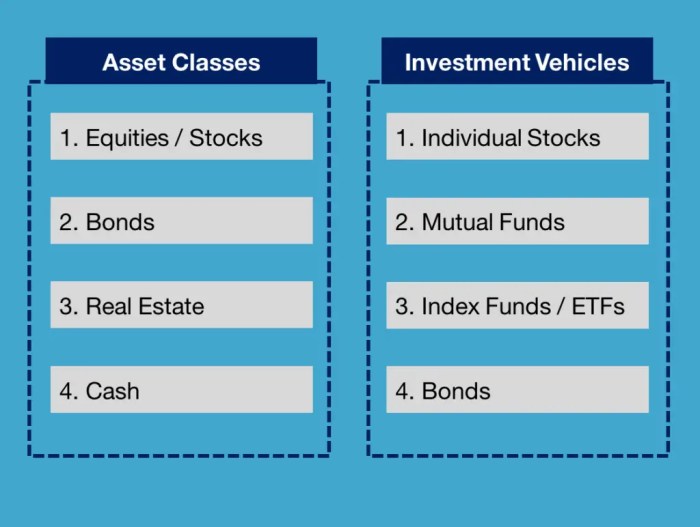

Types of Investment Vehicles

Investment vehicles are the different options available for individuals to invest their money and earn returns. There are several types of investment vehicles, each with its own characteristics and risk levels.

Stocks

Stocks are shares of ownership in a company. When you buy a stock, you become a partial owner of that company. Stocks are known for their potential for high returns but also come with high risk. The value of stocks can fluctuate rapidly based on market conditions and company performance. Examples of stocks include Apple (AAPL), Amazon (AMZN), and Facebook (FB).

Bonds

Bonds are debt securities issued by governments or corporations. When you buy a bond, you are essentially lending money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity. Bonds are generally considered safer than stocks but offer lower returns. Examples of bonds include U.S. Treasury bonds, corporate bonds, and municipal bonds.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. Mutual funds are managed by professional fund managers who make investment decisions on behalf of the investors. Mutual funds offer diversification and are suitable for investors looking to spread their risk. Examples of mutual funds include Vanguard Total Stock Market Index Fund and Fidelity Magellan Fund.

Real Estate

Real estate investments involve purchasing properties with the expectation of earning rental income or capital appreciation. Real estate can provide a steady income stream and potential for long-term growth. However, real estate investments require active management and can be illiquid. Examples of real estate investments include residential properties, commercial properties, and real estate investment trusts (REITs).

Factors to Consider When Choosing Investment Vehicles

When selecting investment vehicles, there are several key factors to consider that can greatly impact your investment strategy and overall financial goals.

Investment Goals Influence the Choice of Investment Vehicles

- Consider whether your goal is long-term growth, income generation, or capital preservation.

- Determine your risk tolerance and investment timeline to align with suitable investment vehicles.

- Choose investment vehicles that match your financial objectives and risk profile.

Liquidity of Different Investment Vehicles

- High liquidity allows for easy buying and selling of assets, providing flexibility in managing funds.

- Less liquid investments may offer higher returns but require a longer commitment period.

- Consider your need for access to funds and how quickly you may need to liquidate investments.

Tax Implications of Various Investment Vehicles

- Understand the tax treatment of different investment vehicles, such as capital gains tax, dividends, or interest income.

- Consider tax-deferred or tax-exempt investment options to minimize tax liabilities.

- Consult with a tax professional to optimize your investment strategy based on tax implications.

Investment Vehicle Performance Metrics

When evaluating investment vehicles, performance metrics play a crucial role in determining the effectiveness and profitability of each option. These metrics provide investors with valuable insights into the historical performance and risk associated with different investment vehicles.

Return on Investment (ROI)

Return on Investment (ROI) is a key performance metric that measures the profitability of an investment relative to its cost. It is calculated by dividing the net profit from the investment by the initial investment cost, expressed as a percentage. A higher ROI indicates a more profitable investment, while a lower ROI suggests lower returns.

ROI = (Net Profit / Cost of Investment) x 100

Volatility

Volatility is another important performance metric that measures the degree of variation in the price of an investment over time. High volatility indicates greater fluctuations in value, while low volatility suggests more stable performance. Investors need to consider volatility when assessing risk and potential returns associated with an investment vehicle.

Comparing Investment Vehicles

Based on historical data, investors can compare the performance of different investment vehicles by analyzing their ROI and volatility. By examining past performance, investors can gain insights into how each investment vehicle has behaved under various market conditions and make informed decisions about which option aligns with their investment goals and risk tolerance.

Diversification for Improved Performance

Diversification is a crucial strategy for enhancing investment vehicle performance. By spreading investments across different asset classes, industries, and regions, investors can reduce risk exposure and improve overall portfolio performance. Diversification helps to mitigate the impact of market volatility on investment returns and enhances the potential for long-term growth.

Investment Vehicle Costs and Fees

Investing in different vehicles comes with various costs and fees that can impact your overall returns. It’s important to understand these expenses to make informed decisions about where to put your money.

Mutual Funds vs. Exchange-Traded Funds (ETFs) Expense Ratios

When comparing mutual funds and ETFs, one key factor to consider is the expense ratio. Mutual funds typically have higher expense ratios compared to ETFs. The expense ratio is the annual fee charged by the fund to cover operating expenses. A lower expense ratio means more of your money is working for you rather than being paid out in fees.

- Mutual Funds: Mutual funds tend to have higher expense ratios due to their active management and higher operating costs.

- Exchange-Traded Funds (ETFs): ETFs generally have lower expense ratios as they are passively managed and have lower operating costs.

Impact of Fees on Investment Returns

Fees can significantly eat into your investment returns over time. Even seemingly small differences in expense ratios can add up to substantial amounts over the long term. For example, if you have a $10,000 investment with an expense ratio of 1%, you would pay $100 in fees annually. This reduces your overall returns and can hinder your investment growth.

Minimizing fees is crucial to maximizing your investment returns.

Strategies to Minimize Costs

To minimize costs when investing in different vehicles, consider the following strategies:

- Choose low-cost index funds or ETFs: These investment vehicles typically have lower expense ratios compared to actively managed funds.

- Look for no-load funds: Avoid funds that charge sales commissions or loads, as these can eat into your returns.

- Consider tax-efficient investing: Opt for investments that are tax-efficient to reduce the impact of taxes on your returns.

- Regularly review and rebalance your portfolio: By periodically reviewing your investments and rebalancing your portfolio, you can ensure you are not paying unnecessary fees.