Yo, diving deep into Strategies for paying off debt, this intro hooks you in with a fresh take that’s gonna make you want to read more. Get ready to level up your financial game!

Now, let’s break it down and get real about how to tackle that debt monster lurking in your bank account.

Importance of paying off debt

Paying off debt is crucial for financial health because it allows individuals to regain control of their finances and work towards achieving financial stability. When debt is left unpaid or accumulates to high levels, it can have negative impacts on various aspects of one’s life.

Negative impacts of carrying high levels of debt

- High interest payments: Carrying a high amount of debt often means paying a significant amount of money in interest, which can hinder one’s ability to save and invest for the future.

- Stress and anxiety: Debt can cause stress and anxiety, impacting mental health and overall well-being.

- Limited financial options: High levels of debt can limit financial flexibility and make it challenging to make important financial decisions.

How reducing debt can improve credit scores and financial stability

- Improving credit scores: By reducing debt, individuals can lower their credit utilization ratio, which can have a positive impact on their credit score.

- Lowering financial burden: Paying off debt can free up more money for savings, investments, and other financial goals, reducing the overall financial burden.

- Building a solid financial foundation: Reducing debt allows individuals to build a solid financial foundation, setting them up for long-term financial success.

Types of debt repayment strategies

When it comes to paying off debt, there are various strategies you can use to tackle your balances. Two popular methods are the snowball and avalanche methods, each with its own approach to debt repayment.

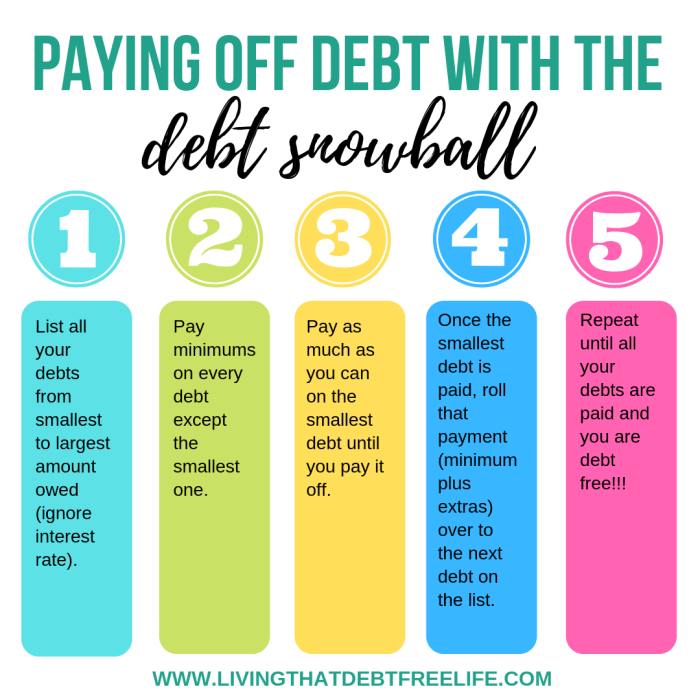

Snowball Method

The snowball method involves paying off your debts from smallest balance to largest, regardless of interest rates. You make minimum payments on all your debts except for the smallest one, which you focus on paying off as quickly as possible. Once the smallest debt is paid off, you move on to the next smallest debt, and so on.

Avalanche Method

On the other hand, the avalanche method prioritizes paying off debts with the highest interest rates first. You make minimum payments on all your debts but put any extra money towards the debt with the highest interest rate. Once that debt is paid off, you move on to the next highest interest rate debt.

Comparison and Contrast

- The snowball method can provide a psychological boost by quickly eliminating smaller debts, giving you momentum to tackle larger balances. However, you may end up paying more in interest over time compared to the avalanche method.

- The avalanche method can save you money in the long run by tackling high-interest debts first. It may take longer to see progress since you are focusing on interest rates rather than balances.

- Consider your financial situation and goals when choosing a debt repayment strategy. Some people prefer the snowball method for its motivational benefits, while others opt for the avalanche method to save on interest costs.

Creating a debt repayment plan

To successfully pay off debt, it is crucial to create a well-thought-out repayment plan. This plan will help you stay organized, motivated, and on track towards financial freedom.

Assess Total Debt and Set Realistic Goals

When creating a debt repayment plan, start by assessing all your debts. Make a list of each debt, including the total amount owed, interest rates, and minimum monthly payments. This will give you a clear picture of your financial situation. Next, set realistic goals for paying off your debt. Determine how much you can realistically afford to put towards debt repayment each month.

Set Specific Goals and Timelines

Setting specific goals and timelines is essential for staying motivated and focused on paying off debt. Create a timeline for when you aim to pay off each debt and set specific milestones along the way. For example, aim to pay off a certain amount of debt by a particular date. This will help you track your progress and stay motivated.

Prioritize Debts Based on Interest Rates or Balances

When creating a debt repayment plan, it’s important to prioritize your debts strategically. You can choose to prioritize debts based on interest rates or balances. One common strategy is to pay off debts with the highest interest rates first, as they are costing you the most money in the long run. Another approach is to pay off debts with the smallest balances first (the debt snowball method) to gain momentum and motivation as you see debts being paid off quickly.

Budgeting and cutting expenses

Budgeting plays a crucial role in debt repayment as it helps individuals track their income and expenses, allowing them to allocate funds towards paying off debt. By creating a budget, individuals can identify areas where they can cut expenses to free up more money for debt payments. Tracking spending and making adjustments are essential to ensure that repayment goals are met.

Strategies for Cutting Expenses

- Reduce dining out and cook meals at home to save money on food expenses.

- Cancel unused subscriptions or services to eliminate unnecessary expenses.

- Shop for generic brands and use coupons to save on groceries and household items.

- Lower utility bills by conserving energy and water usage in the home.

- Avoid impulse purchases and stick to a shopping list to prevent overspending.

Importance of Tracking Spending

Tracking spending is vital to understand where money is being allocated and identify areas where expenses can be reduced. By closely monitoring spending habits, individuals can make informed decisions on where to cut costs and allocate more funds towards debt repayment.

Making Adjustments to Meet Repayment Goals

It’s essential to regularly review the budget and make adjustments as needed to stay on track with debt repayment goals. If income or expenses change, adjustments should be made to ensure that enough money is allocated towards paying off debt. By staying proactive and flexible with the budget, individuals can make steady progress towards becoming debt-free.

Increasing income to pay off debt

In order to pay off debt faster, it’s crucial to find ways to increase your income. By boosting your earnings through side hustles, freelancing, or other means, you can allocate more money towards paying off your debts. This can help you become debt-free sooner and save money on interest payments in the long run.

Side Hustles and Freelancing

- Consider starting a side hustle, such as driving for a rideshare service, delivering food, or selling handmade crafts online.

- Freelancing in your area of expertise can also be a great way to earn extra income on the side.

- Use online platforms to find gigs and projects that match your skills and interests.

Benefits of Using Extra Income

- Accelerate debt repayment by making larger payments towards your debts each month.

- Reduce the total amount of interest you’ll pay over time, saving you money in the long term.

- Improve your financial situation and increase your overall financial stability.

Tips for Staying Motivated

- Set specific goals for how much extra income you want to earn each month to put towards debt repayment.

- Reward yourself for reaching milestones or achieving your income targets.

- Stay focused on the end goal of becoming debt-free and the financial freedom that comes with it.

Seeking professional help with debt

When you find yourself overwhelmed by debt and struggling to make minimum payments, it might be time to seek help from credit counselors or debt management agencies. These professionals can provide guidance and support to help you navigate through your financial challenges.

Benefits of debt consolidation

Debt consolidation is a strategy where you combine multiple debts into a single, more manageable loan. This can simplify your payments and potentially lower your interest rates, making it easier to pay off your debt over time. By consolidating your debts, you may also be able to negotiate with creditors for better repayment terms.

- Consolidating multiple debts into one monthly payment

- Potentially lowering interest rates

- Improving your credit score over time

Debt consolidation can help streamline your finances and make it easier to focus on paying off your debt without feeling overwhelmed by multiple payments.

Benefits of negotiation with creditors

Negotiating with creditors can involve discussing repayment plans, interest rates, or even settling debts for less than what you owe. By working with your creditors directly, you may be able to come to an agreement that is more manageable for your financial situation.

- Potential for lower monthly payments

- Opportunity to settle debts for less than the full amount

- Reducing the overall amount of debt owed

Negotiating with creditors can help you find a solution that works for both parties and allows you to make progress towards paying off your debt.

Resources for individuals struggling with debt

There are various resources available for individuals facing financial hardship due to debt. These resources may include non-profit credit counseling agencies, debt relief programs, or government assistance programs designed to help individuals get back on track financially.

- Non-profit credit counseling agencies offering free or low-cost services

- Debt relief programs that may provide assistance with negotiating debts

- Government assistance programs for individuals in financial need

Seeking help from these resources can provide you with the support and guidance needed to tackle your debt and work towards a more stable financial future.