Diving into the realm of Understanding economic cycles, we embark on a journey filled with twists and turns, exploring the intricate patterns that govern our financial landscape. Brace yourself for a ride like no other as we uncover the secrets behind economic cycles and their profound impact on industries worldwide.

As we delve deeper into this fascinating topic, we’ll uncover the essence of economic cycles, dissecting the key components that drive these phenomena and shedding light on their far-reaching implications.

Definition of Economic Cycles

Economic cycles refer to the recurring patterns of expansion and contraction in economic activity over time. These cycles are characterized by shifts in GDP, employment rates, consumer spending, and other economic indicators.

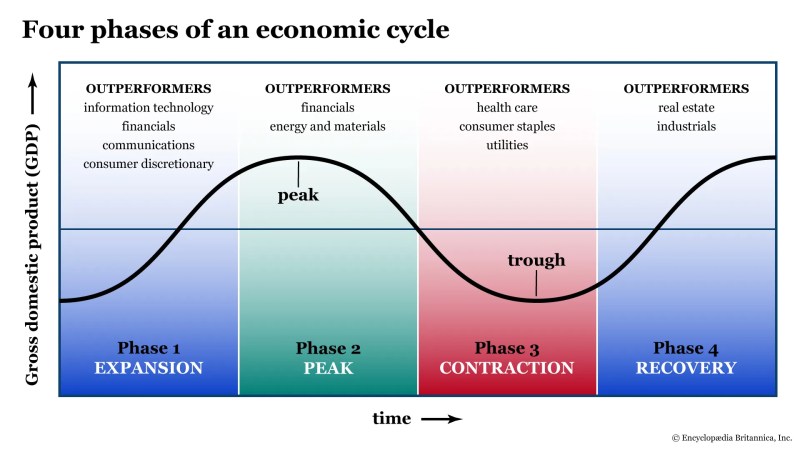

Phases of an Economic Cycle

- The Expansion Phase: During this phase, the economy is growing, businesses are thriving, and consumer confidence is high. This is typically marked by increased investments, rising employment rates, and overall economic prosperity.

- The Peak Phase: This phase represents the highest point of the economic cycle, where growth reaches its maximum level. It is characterized by full employment, high levels of production, and strong consumer demand.

- The Contraction Phase: Also known as the recession phase, this period sees a decline in economic activity. Businesses may cut back on investments, leading to layoffs, reduced consumer spending, and a decrease in GDP.

- The Trough Phase: The trough is the lowest point of the economic cycle, where economic activity hits rock bottom. Unemployment rates are high, businesses struggle, and consumer confidence is low.

Impact of Economic Cycles on Industries

- Real Estate: During the expansion phase, the real estate market booms with high demand for properties and increased construction. In contrast, during a contraction phase, the market experiences a downturn with declining prices and sluggish sales.

- Automotive Industry: Economic cycles heavily influence the automotive sector. In times of economic growth, consumers are more likely to purchase cars, leading to increased sales. Conversely, during a recession, car sales tend to decline as people cut back on big purchases.

- Technology Sector: The technology industry is often resilient to economic cycles, as innovation and demand for new products drive growth. However, during a recession, companies may reduce spending on tech upgrades and expansions.

Factors Influencing Economic Cycles

When it comes to understanding economic cycles, there are several key factors that play a significant role in shaping the ups and downs of the economy. These factors can range from internal to external influences that impact the overall economic performance of a country.

Monetary Policy

Monetary policy, set by central banks, plays a crucial role in influencing economic cycles. By adjusting interest rates, controlling the money supply, and implementing other monetary tools, central banks can stimulate or slow down economic activity.

Fiscal Policy

Government policies related to taxation, spending, and budgeting also have a significant impact on economic cycles. During economic downturns, governments may increase spending to boost demand, while during periods of high inflation, they may reduce spending to curb rising prices.

Consumer Behavior

Consumer behavior is another key factor that influences economic cycles. When consumers feel confident about the economy, they tend to spend more, leading to increased economic activity. On the other hand, during times of uncertainty or recession, consumers may cut back on spending, causing a slowdown in the economy.

Types of Economic Indicators

When it comes to understanding economic cycles, it’s crucial to look at different types of economic indicators that can provide insights into the health of the economy. These indicators can be categorized as leading, lagging, or coincident, each playing a unique role in predicting economic trends.

Leading Economic Indicators

Leading economic indicators are signals that change before the economy as a whole changes. These indicators are used to predict the direction of the economy in the near future. Examples of leading economic indicators include:

- Stock market performance

- Building permits

- Consumer confidence index

Lagging Economic Indicators

Lagging economic indicators, on the other hand, change after the economy as a whole does. They confirm long-term trends and are often used to validate or confirm a change in the economy. Examples of lagging economic indicators include:

- Unemployment rate

- Corporate profits

- Outstanding loan balances

Coincident Economic Indicators

Coincident economic indicators change at the same time as the economy. They reflect the current state of the economy and are used to assess its present condition. Examples of coincident economic indicators include:

- Industrial production

- Gross domestic product (GDP)

- Employment levels

These economic indicators are crucial tools used by economists, policymakers, and investors to analyze economic data and predict future economic cycles. By understanding the different types of indicators and how they interact, stakeholders can make more informed decisions in a dynamic economic environment.

Business Strategies for Different Economic Phases

In the ever-changing economic landscape, businesses must be adaptable and strategic to thrive. Understanding how to navigate different economic phases is crucial for long-term success.

During a Recession

During a recession, businesses often face challenges such as decreased consumer spending and shrinking profit margins. To weather the storm, companies may adopt the following strategies:

- Cost-cutting Measures: Implementing cost-saving initiatives such as reducing workforce, renegotiating contracts, or consolidating operations.

- Diversification: Exploring new markets or product lines to offset losses in core business areas.

- Marketing and Promotion: Increasing marketing efforts to maintain brand visibility and attract customers despite economic downturn.

Capitalizing on Growth Periods

During growth periods in the economic cycle, businesses have the opportunity to expand and maximize profits. Strategies to capitalize on these periods include:

- Investing in Innovation: Allocating resources to research and development to stay ahead of competitors and meet evolving consumer needs.

- Expanding Market Reach: Entering new markets or segments to increase customer base and revenue streams.

- Strategic Partnerships: Collaborating with other businesses to leverage expertise, resources, and market access for mutual benefit.

Adapting Business Strategies

It is essential for businesses to tailor their strategies to the specific economic phase they are in. By adapting to different economic conditions, companies can enhance their resilience and competitiveness. Some important considerations include:

- Monitoring Economic Indicators: Keeping a close eye on key economic indicators to anticipate changes and adjust strategies accordingly.

- Flexible Planning: Developing contingency plans and remaining agile in response to shifting market dynamics.

- Talent Management: Investing in employee training and development to ensure a skilled workforce capable of navigating economic uncertainties.