Yo, diving into the world of Insurance policy comparisons is key to making smart choices that save you major bucks. From life to health to auto to home insurance, we’re breaking down how to compare ‘em all.

Importance of Insurance Policy Comparisons

In the world of insurance, comparing policies is like doing your homework before a big test. It’s super important to make sure you’re making the right choice and getting the best deal possible.

Benefits of Comparing Insurance Policies

- Save Money: By comparing different insurance policies, you can find the one that offers the coverage you need at a price that fits your budget. It’s like finding a hidden treasure chest of savings!

- Customized Coverage: Each insurance policy has its own unique features and benefits. By comparing them, you can tailor your coverage to suit your specific needs, whether it’s for your car, home, or health.

- Avoid Overpaying: Without comparing policies, you might end up paying more than you need to for the same coverage. It’s like going to a fancy restaurant and ordering the most expensive dish without checking out the menu first!

Types of Insurance Policies to Compare

When comparing insurance policies, it is essential to understand the various types of insurance available in the market. Different types of insurance policies serve different purposes and offer varying levels of coverage.

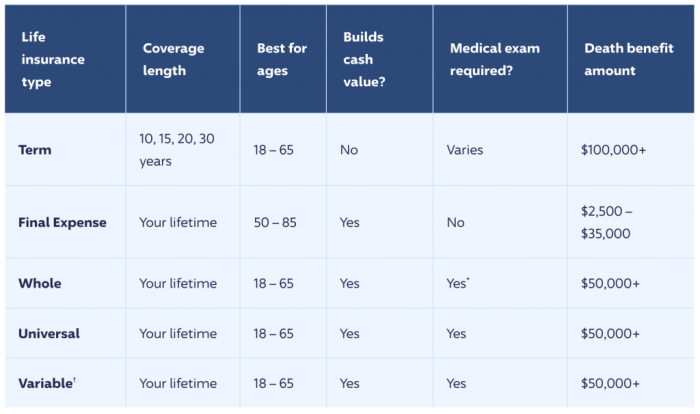

Life Insurance

Life insurance provides financial protection to the beneficiaries of the insured individual in the event of their death. There are two main types of life insurance: term life insurance and whole life insurance. Term life insurance offers coverage for a specific period, while whole life insurance provides coverage for the entire life of the insured.

Health Insurance

Health insurance covers medical expenses incurred by the insured individual. It can include coverage for hospitalization, doctor visits, prescription medications, and preventive care. When comparing health insurance policies, individuals should consider factors such as premiums, deductibles, co-pays, network coverage, and exclusions.

Auto Insurance

Auto insurance provides coverage for vehicles in case of accidents, theft, or damage. There are different types of auto insurance, including liability insurance, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. When comparing auto insurance policies, individuals should consider factors such as coverage limits, deductibles, premiums, discounts, and additional benefits.

Home Insurance

Home insurance protects the insured individual’s home and personal belongings from risks such as fire, theft, natural disasters, and liability claims. There are different types of home insurance policies, including HO-1, HO-2, HO-3, HO-5, and HO-6 policies. When comparing home insurance policies, individuals should consider factors such as coverage limits, deductibles, premiums, exclusions, and additional coverage options.

Parameters for Comparison

When comparing insurance policies, it is crucial to consider various parameters that can greatly impact the overall value of the policy. These parameters include coverage limits, deductibles, premiums, and exclusions. Understanding these factors can help you make an informed decision when choosing the right insurance policy for your needs.

Coverage Limits

Coverage limits refer to the maximum amount an insurance company will pay out for a covered loss. When comparing policies, it is important to look at the coverage limits for different types of damages or claims. Make sure the coverage limits align with your potential risks and financial needs. Higher coverage limits may mean higher premiums, but they can provide better protection in case of a major loss.

Deductibles

Deductibles are the amount you must pay out of pocket before your insurance coverage kicks in. Lower deductibles typically mean higher premiums, while higher deductibles can lower your premiums. When comparing policies, consider how much you can afford to pay in deductibles in the event of a claim. Choose a deductible that strikes the right balance between affordability and coverage.

Premiums

Premiums are the amount you pay for your insurance coverage. When comparing policies, look at the premiums for similar coverage amounts and deductibles. Consider the long-term affordability of the premiums and any potential rate increases in the future. While lower premiums may be enticing, make sure you are not sacrificing essential coverage for a cheaper price.

Exclusions

Exclusions are specific situations or events that are not covered by an insurance policy. When comparing policies, pay close attention to the exclusions listed in each policy. Make sure you understand what is not covered and evaluate whether those exclusions align with your needs and potential risks. Choosing a policy with fewer exclusions can provide more comprehensive coverage.

Tips for Effective Policy Comparisons

When comparing insurance policies, it’s essential to have a solid strategy in place to ensure you make an informed decision. Here are some tips for conducting effective policy comparisons:

Understand Your Needs

- Before comparing policies, clearly define what you need from an insurance policy.

- Identify the coverage amount, type of coverage, and any specific features you require.

Compare Apples to Apples

- Make sure you are comparing similar policies with the same coverage types and limits.

- Look at the exclusions and limitations of each policy to ensure you are making a fair comparison.

Look Beyond the Premium

- While the premium is important, don’t base your decision solely on price.

- Consider the overall value of the policy, including coverage, deductibles, and customer service.

Read the Fine Print

- Take the time to carefully read the policy documents and understand the terms and conditions.

- Pay attention to any exclusions, limitations, or hidden fees that may impact your coverage.

Seek Expert Advice

- Consider consulting with an insurance agent or broker to help you navigate the complexities of different policies.

- Get recommendations from trusted sources to ensure you are making a well-informed decision.