Yo, listen up! Stock options are like the cool kids of the investment world, offering a whole new level of financial freedom and flexibility. Get ready to dive into this exciting topic and level up your money game!

Stock options are not just your average investment tool – they’re like the VIP pass to the stock market party, where you can make moves that others can only dream of. So, buckle up and let’s explore the ins and outs of stock options together.

What are stock options?

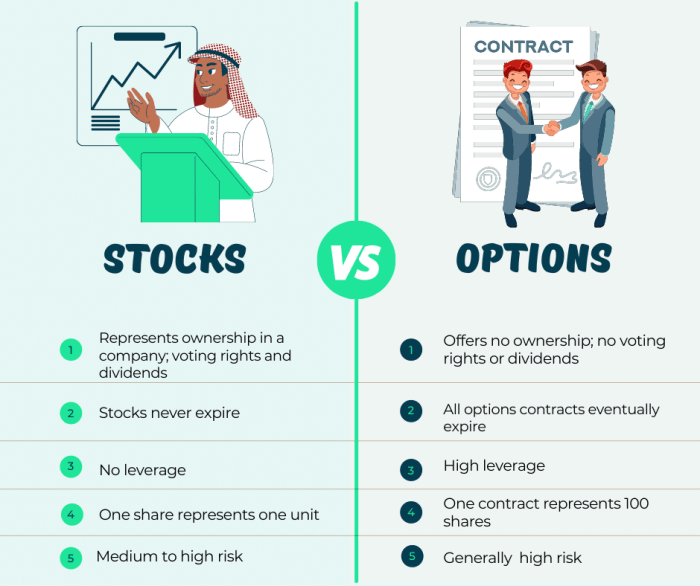

Stock options are financial instruments that give the holder the right, but not the obligation, to buy or sell a specific amount of a stock at a predetermined price within a set time period. This provides investors with the opportunity to profit from changes in stock prices without actually owning the stock itself.

Types of Stock Options

- Call Options: These give the holder the right to buy a specific amount of stock at a predetermined price before the expiration date.

- Put Options: These give the holder the right to sell a specific amount of stock at a predetermined price before the expiration date.

- Employee Stock Options: These are typically offered as part of an employee’s compensation package, allowing them to buy company stock at a discounted price.

Benefits and Risks of Stock Options

Stock options offer several benefits, such as potential for high returns with a small upfront investment, hedging against market fluctuations, and leveraging investment opportunities. However, they also come with risks, including the potential for loss if the stock price does not move as anticipated, the expiration of options rendering them worthless, and the complexity of options trading.

Types of stock options

Stock options are a popular investment tool that gives investors the right, but not the obligation, to buy or sell a stock at a predetermined price within a specific time frame. There are two main types of stock options: call options and put options.

Call options vs. Put options

Call options give the holder the right to buy a stock at a specified price, known as the strike price, before the option expires. On the other hand, put options give the holder the right to sell a stock at a specified price before the option expires. Call options are typically used by investors who expect the stock price to rise, while put options are used by investors who anticipate the stock price to fall.

In-the-money, At-the-money, and Out-of-the-money options

– In-the-money options: This refers to a situation where the stock price is favorable for the option holder. For call options, it means the stock price is above the strike price. For put options, it means the stock price is below the strike price.

– At-the-money options: This occurs when the stock price is equal to the strike price. It is considered a neutral position for the option holder.

– Out-of-the-money options: This means the stock price is not favorable for the option holder. For call options, it means the stock price is below the strike price. For put options, it means the stock price is above the strike price.

Using stock options for hedging or speculation

Stock options can be used for hedging to protect against potential losses in a stock position. For example, an investor with a long stock position can purchase put options to hedge against a potential decline in the stock price. On the other hand, stock options can also be used for speculation, where investors take positions based on their expectations of the stock price movement. For instance, an investor can buy call options if they believe a stock will increase in value, aiming to profit from the price appreciation without owning the actual stock.

Understanding option contracts

In the world of stock options, an option contract is a financial derivative that gives the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price within a certain timeframe. There are two main types of options: call options and put options.

Key Components of an Option Contract

- The strike price is the price at which the option holder can buy or sell the underlying asset.

- The expiration date is the date by which the option must be exercised or it will expire worthless.

- The premium is the price paid by the option holder to the option writer for the right to buy or sell the underlying asset.

- The underlying asset is the stock, index, or other financial instrument that the option is based on.

Option Pricing

Option pricing is determined by various factors, including the current price of the underlying asset, the strike price, the expiration date, market volatility, and interest rates. One of the most common models used to determine option pricing is the Black-Scholes model, which takes all of these factors into account.

American-style vs. European-style options

- American-style options can be exercised at any time before the expiration date, while European-style options can only be exercised on the expiration date.

- American-style options tend to be more flexible but may come at a higher cost due to the additional flexibility.

- European-style options are generally less expensive but offer less flexibility in terms of when they can be exercised.

Strategies for trading stock options

When it comes to trading stock options, there are several popular strategies that investors can utilize to maximize returns and manage risk. Understanding these strategies is crucial for anyone looking to venture into the world of options trading.

Covered Calls

Covered calls are a popular strategy where an investor sells a call option on a stock they already own. This strategy allows the investor to generate income from the premium received for selling the call option, while also potentially profiting from any increase in the stock’s price. It’s a great way to enhance returns on a stock position.

Protective Puts

Protective puts involve buying a put option to protect a stock position from potential losses. If the stock price were to fall, the put option would increase in value, offsetting the losses on the stock. This strategy is commonly used as a form of insurance to safeguard against downside risk.

Straddles

A straddle strategy involves buying both a call option and a put option on the same stock with the same expiration date. This strategy is typically used when the investor expects a significant price movement in either direction. It allows the investor to profit from the volatility in the stock price.

Analyzing Risk and Reward

When trading stock options, it’s crucial to analyze the risk and reward of each strategy. Investors should consider factors such as the time until expiration, the volatility of the underlying stock, and the potential payoff. By assessing these factors, investors can make informed decisions and manage their risk effectively.

Generating Income and Protecting Positions

Options can be used not only to generate income but also to protect existing stock positions. For example, selling covered calls can provide a steady stream of income, while protective puts can safeguard against potential losses. By combining different strategies, investors can create a well-rounded approach to options trading that suits their financial goals.