Diving into Risk tolerance assessment, this introduction immerses readers in a unique and compelling narrative. From understanding the importance of risk tolerance to exploring the factors that influence it, get ready to embark on a journey towards financial empowerment.

As we delve deeper, we’ll uncover the methods of assessing risk tolerance and the implications it has on investment decisions. So buckle up and get ready to navigate the world of financial planning like never before.

Importance of Risk Tolerance Assessment

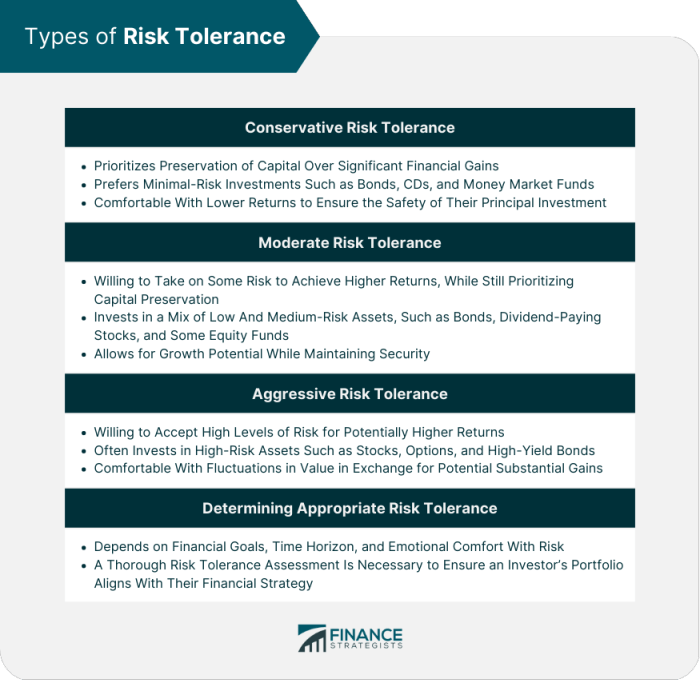

When it comes to financial planning, understanding your risk tolerance is key. Risk tolerance assessment helps individuals determine how much risk they are willing to take on when investing their money. This assessment takes into account factors such as age, income, financial goals, and personal comfort level with risk.

Impact on Investment Decisions

- Allocating Assets: Based on your risk tolerance, you can determine the right mix of investments to achieve your financial goals. For example, a conservative investor with low risk tolerance might lean towards bonds and cash equivalents, while an aggressive investor with high risk tolerance might prefer stocks and real estate.

- Long-term Planning: Understanding your risk tolerance can help you make informed decisions about the length of time you are willing to invest your money. If you have a low risk tolerance and need your funds in the short term, you may opt for more stable investments. On the other hand, if you have a higher risk tolerance and a longer time horizon, you may consider more volatile investments with potentially higher returns.

- Emotional Resilience: Knowing your risk tolerance can also prepare you for market fluctuations and prevent emotional decision-making during turbulent times. By aligning your investments with your risk tolerance, you can stay committed to your financial plan without being swayed by short-term market movements.

Factors Influencing Risk Tolerance

When it comes to risk tolerance, there are several factors that can influence an individual’s willingness to take on risk in their investments. These factors can range from personal characteristics to financial circumstances, all of which play a role in shaping how comfortable someone is with risk.

Age and Financial Goals

Age and financial goals are two key factors that can greatly impact an individual’s risk tolerance. Younger individuals who have more time ahead of them to recover from any potential losses may be more willing to take on higher risks in pursuit of greater returns. On the other hand, older individuals who are nearing retirement may have a lower risk tolerance as they have less time to recover from any losses and prioritize capital preservation over growth. Additionally, an individual’s financial goals, such as saving for a house or funding their children’s education, can also influence how much risk they are willing to take with their investments.

Role of Past Investment Experiences

Past investment experiences can also play a significant role in shaping an individual’s risk tolerance. Someone who has experienced significant losses in the past may be more risk-averse and cautious with their investments, while someone who has had successful investment outcomes may be more comfortable with taking on higher risks. These past experiences can shape an individual’s perception of risk and influence their future investment decisions.

Methods of Assessing Risk Tolerance

Assessing risk tolerance is crucial in making informed investment decisions. There are several popular methods used to assess risk tolerance, including quantitative and qualitative approaches. Let’s explore these methods in detail.

Quantitative vs. Qualitative Approaches

Quantitative approaches to risk tolerance assessment involve assigning numerical values to different aspects of risk, such as financial goals, time horizon, and investment preferences. On the other hand, qualitative approaches focus on understanding an individual’s attitudes, beliefs, and emotional responses to risk. While quantitative methods provide a more objective assessment, qualitative approaches offer insights into the psychological aspects of risk tolerance.

Risk Tolerance Questionnaires

Risk tolerance questionnaires are commonly used tools to assess an individual’s risk tolerance. These questionnaires typically consist of a series of questions related to investment preferences, financial goals, time horizon, and reactions to hypothetical scenarios. By analyzing the responses, financial advisors can gauge an individual’s risk tolerance level and tailor investment recommendations accordingly.

Implications of Risk Tolerance Assessment

Risk tolerance assessment plays a crucial role in guiding individuals towards making informed investment decisions. Let’s delve into the implications of understanding one’s risk tolerance.

Mismatched Risk Tolerance and Investment Decisions

- When an individual’s risk tolerance does not align with their investment decisions, it can lead to emotional reactions during market fluctuations.

- This mismatch may result in panic selling during market downturns or holding onto investments longer than advisable, impacting overall portfolio performance.

- Understanding one’s risk tolerance can help in avoiding impulsive decisions that may harm long-term financial goals.

Creating a Diversified Investment Portfolio

- Through risk tolerance assessment, investors can determine the right mix of assets to create a diversified investment portfolio.

- By spreading investments across different asset classes based on risk tolerance, individuals can reduce the overall risk while maximizing returns.

- A diversified portfolio can help in mitigating the impact of market volatility and achieving long-term financial stability.

Relationship between Risk Tolerance Assessment and Financial Well-Being

- Conducting a risk tolerance assessment allows individuals to understand their comfort level with investment risk, leading to more strategic financial planning.

- By aligning investment decisions with risk tolerance, individuals can create a financial plan that considers their goals, timelines, and risk preferences.

- Ultimately, a well-matched risk tolerance assessment can contribute to overall financial well-being by ensuring a balanced approach to investing and wealth management.