Diving into Emergency fund planning, this introduction immerses readers in a captivating narrative that highlights the importance of preparing for unforeseen circumstances. From the necessity of having a safety net to the strategies for building and managing it, this guide will equip you with the essential knowledge to secure your financial future with style.

Importance of Emergency Fund Planning

Having an emergency fund is crucial for financial stability as it provides a safety net for unexpected situations that may arise.

Benefits of Having an Emergency Fund

1. Financial Security: An emergency fund ensures you have money set aside to cover unexpected expenses without relying on credit cards or loans.

2. Peace of Mind: Knowing you have a financial cushion in place can reduce stress and anxiety during difficult times.

3. Flexibility: Having an emergency fund allows you to handle unexpected events, such as medical emergencies or job loss, without disrupting your long-term financial goals.

Examples of How an Emergency Fund Can Help

- Car Repairs: If your car breaks down unexpectedly, having an emergency fund can help cover the costs without putting a strain on your budget.

- Medical Expenses: In case of a sudden illness or injury, an emergency fund can cover medical bills and related expenses.

- Job Loss: If you lose your job, having an emergency fund can provide financial support while you search for a new job without going into debt.

Determining the Right Amount for an Emergency Fund

Determining the ideal size for your emergency fund is crucial to ensure financial stability in times of need. It involves calculating the amount based on your income, expenses, and specific financial situation.

Calculating the Required Emergency Fund Size

- One common method is to save three to six months’ worth of living expenses. This can vary depending on individual circumstances, such as job stability, health status, and other factors.

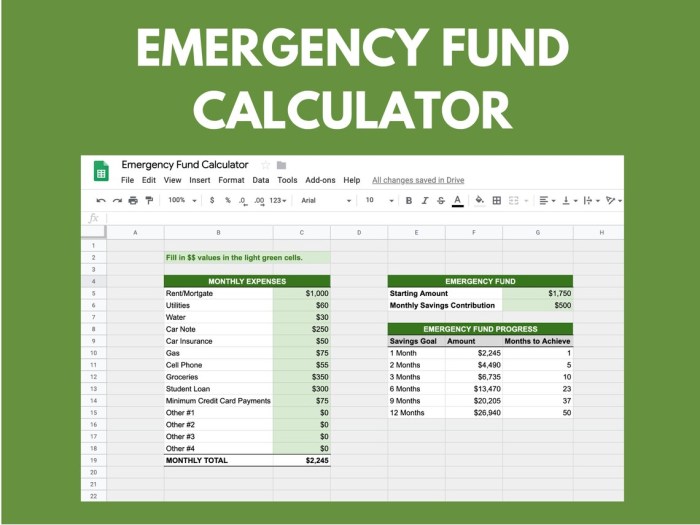

- Consider your monthly expenses, including rent/mortgage, utilities, groceries, insurance, and any other essential costs. Multiply this amount by the number of months you aim to cover.

- Factor in any additional expenses that may arise during an emergency, such as medical bills or car repairs.

Factors to Consider for Setting Aside the Appropriate Amount

- Your job stability and the likelihood of facing unexpected expenses.

- Your health status and potential medical costs that may arise.

- The number of dependents you have and their financial needs.

- The overall stability of the economy and the job market in your area.

Examples of Formulas for Calculating Emergency Fund Size

Six months’ worth of living expenses = 6 x Monthly expenses

Three months’ worth of expenses + Additional expenses = Emergency fund size

Building an Emergency Fund

Building an emergency fund is crucial for financial stability and peace of mind. It allows you to handle unexpected expenses without going into debt or disrupting your long-term financial goals.

Strategies for Saving and Building an Emergency Fund

- Automatic Transfers: Set up automatic transfers from your checking account to a separate savings account dedicated to your emergency fund. This ensures consistent contributions without the temptation to spend the money elsewhere.

- Side Hustles: Consider taking on a side hustle or freelance work to boost your income specifically for your emergency fund. The extra earnings can accelerate the growth of your fund.

- Cutting Expenses: Identify areas where you can cut back on expenses, such as dining out less frequently, canceling unused subscriptions, or finding more affordable alternatives for everyday items.

Best Practices for Consistently Contributing to the Fund

- Set Realistic Goals: Determine a monthly or bi-weekly contribution amount that is feasible for your budget. Consistency is key in building an emergency fund over time.

- Review and Adjust: Regularly review your budget and expenses to ensure that you are on track with your savings goals. Adjust as needed to stay committed to building your fund.

- Celebrate Milestones: Acknowledge and celebrate reaching certain milestones in your emergency fund journey. It can help motivate you to continue saving and building your fund.

Tips on Prioritizing Building an Emergency Fund Alongside Other Financial Goals

- Emergency Fund First: Make building your emergency fund a priority before focusing on other financial goals, such as investing or saving for a vacation. Having a safety net in place is essential.

- Allocate Percentage: Allocate a percentage of your income towards your emergency fund before allocating for other expenses or goals. This ensures that saving is a top priority.

- Track Progress: Keep track of the growth of your emergency fund and celebrate each milestone achieved. Seeing your fund grow can be a motivating factor to continue saving.

Investment Options for Emergency Funds

When it comes to investing your emergency fund, it’s important to strike a balance between accessibility and growth potential. Here are some investment vehicles suitable for emergency funds:

Savings Accounts

Savings accounts are a popular choice for emergency funds due to their liquidity and low-risk nature. While the interest rates may be lower compared to other investments, the money is easily accessible when needed.

Certificates of Deposit (CDs)

CDs offer higher interest rates than savings accounts but require you to keep your money locked in for a specific period. They are a good option if you don’t need immediate access to your emergency fund.

Money Market Accounts

Money market accounts offer higher interest rates than regular savings accounts and provide some check-writing abilities. They are a good option for emergency funds as they offer a blend of liquidity and higher returns.

Short-Term Bonds

Investing in short-term bonds can provide slightly higher returns than savings accounts or CDs. While they carry slightly more risk, they can be a good option to boost the growth of your emergency fund.

Low-Risk Mutual Funds

Low-risk mutual funds, such as bond funds, can provide more growth potential for your emergency fund compared to traditional savings accounts. However, they still maintain a level of stability and are less volatile than other types of investments.

Remember, the key is to balance liquidity and growth when choosing investment options for your emergency fund.

Managing and Accessing an Emergency Fund

Managing an emergency fund is crucial to ensure it remains accessible during times of need. It is important to keep the fund liquid and easily available when emergencies arise. Here are some tips on how to manage and access your emergency fund without compromising your financial goals.

Regularly Review and Update

- Make sure to review your emergency fund periodically to ensure it aligns with your current financial situation and needs.

- Adjust the amount in your emergency fund as necessary based on changes in expenses, income, or other financial circumstances.

Separate from Regular Savings

- Keep your emergency fund separate from your regular savings to avoid accidentally dipping into it for non-emergencies.

- Consider opening a separate high-yield savings account specifically for your emergency fund to earn some interest while keeping it easily accessible.

Establish Clear Criteria for Withdrawals

- Define specific criteria for when it is appropriate to access your emergency fund, such as unexpected medical expenses, car repairs, or job loss.

- Avoid using the fund for non-urgent expenses or impulse purchases to ensure it remains available when truly needed.

Replenish After Use

- Once you have used your emergency fund, make it a priority to replenish the amount as soon as possible to maintain your financial safety net.

- Allocate a portion of your income towards rebuilding the fund until it reaches its original level.